Should You Buy or Rent in 2025? A Financial Perspective

- Editor

- Aug 5

- 4 min read

by KarNivesh | 05 August, 2025

The age-old question of buying vs renting has become more complex in 2025, thanks to rising property prices, shifting interest rates, and evolving lifestyle needs. Whether you should buy or rent depends heavily on your location, financial goals, and how long you plan to stay in one place.

Current Market Trends

In 2025, property prices in major Indian cities like Mumbai, Bengaluru, and Pune are projected to rise 7-10%. Demand for premium homes (above ₹1 crore) is increasing, yet affordable housing is becoming harder to find. On the supply side, housing inventory is improving, especially in regions like NCR, Mumbai, and Bengaluru, offering better choices for buyers.

Mortgage rates remain between 8.25%-9.5%, slightly elevated due to global inflationary concerns. While high compared to pandemic-era lows, these rates are still manageable and are expected to remain steady through 2025.

Buy vs Rent: What the Numbers Say?

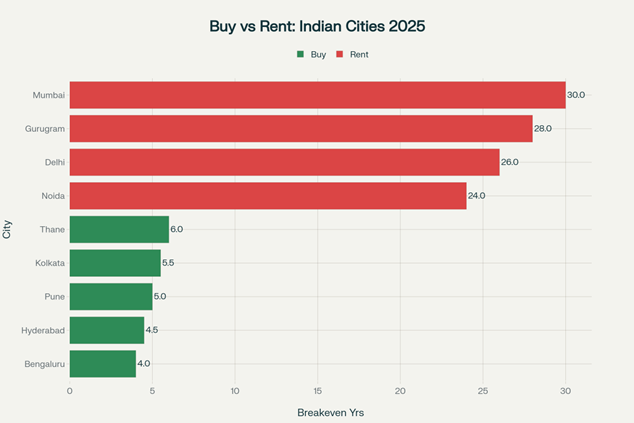

Where Buying Makes Sense?

Cities like Bengaluru, Hyderabad, Pune and Kolkata offer favorable conditions for buyers. For example, in Bengaluru, buying a ₹1 crore home could break even with renting in just 3-5 years. In Hyderabad, this breakeven can be as low as 3 years, thanks to affordable prices and high rental yields.

These cities have a price-to-rent ratio around 17-20, meaning that over time, the financial benefits of ownership including tax benefits and property appreciation can outweigh renting.

Where Renting Wins?

In contrast, cities like Mumbai, Delhi, Noida, and Gurugram present a better case for renting. In Mumbai, a ₹2.4 crore property may only fetch ₹60,000-85,000 in rent per month, pushing the price-to-rent ratio above 28. That means it would take nearly three decades of rent to equal the purchase price making renting a smarter choice, especially for short- to mid-term stays.

Understanding Total Costs

Buying a home involves significant upfront costs down payments (₹20–25 lakh), stamp duty, registration fees, and more. Ongoing expenses like EMIs, maintenance, taxes, and repairs often total ₹75,000–85,000/month, while renting the same property might cost ₹45,000-60,000/month.

Still, homeowners gain from tax deductions and build equity over time. Under current tax laws, you can claim deductions up to ₹3 lakhs on home loan interest, with additional benefits for first-time buyers under Section 80EEA.

Renters don’t enjoy these benefits but can invest the difference. A disciplined renter who invests the down payment and cost savings could potentially build significant wealth, particularly if staying in one location for a shorter duration.

Tax Benefits in 2025

The Union Budget 2025 introduced increased home loan interest deductions (up to ₹3 lakhs/year), making buying even more attractive. Under the new tax regime, homeowners also receive benefits previously limited to the old system. These changes especially favor high-income individuals who itemize deductions.

Renters, on the other hand, lose out under the new tax regime as House Rent Allowance (HRA) deductions are not applicable, adding another tilt in favor of buying.

Lifestyle Factors: Beyond the Numbers

Renting offers flexibility a major advantage for young professionals who may relocate or upgrade frequently. Rentals also provide access to high-end amenities like gyms and pools at a fraction of the ownership cost.

Owning, however, brings stability, emotional satisfaction, and protection from rising rents which have surged 10-15% in some metros like Bengaluru in early 2025. It’s a better fit for families and individuals planning to settle long-term.

Emerging Opportunities in Tier-2 Cities

Cities like Kanpur, Lucknow, Indore, and Surat are seeing increased housing demand and better rental yields. With growing infrastructure and improving connectivity, these cities are becoming attractive investment destinations with a lower entry cost and high growth potential.

Key Considerations Before Deciding

Financial Readiness: Ensure you have a stable income, good credit (750+), and emergency savings before buying.

Duration of Stay: If you plan to stay in one place for over 5-7 years, buying often makes more sense.

City-wise Breakeven Point: Use price-to-rent ratios and breakeven analysis to determine what works in your location.

Lifestyle Needs: Flexibility matters more in early career stages, while stability becomes vital for families.

Recommendations by Age Group

Young professionals (25-30): Rent, especially in high-cost cities. Focus on career mobility and savings.

Families (30-45): Consider buying in cities with reasonable breakeven periods like Bengaluru or Pune.

Pre-retirees (45-55): Buying is advisable for long-term security and wealth preservation.

Investors: Own a primary home and consider rental property in growth corridors for income and diversification.

The buy-vs-rent decision in 2025 isn’t one-size-fits-all. While buying makes strong financial sense in cities like Hyderabad and Bengaluru, renting may be smarter in Mumbai or Delhi unless you have long-term plans.

Tax benefits, property appreciation, and stability favor ownership if your finances and life plans support it. But flexibility, lower upfront costs, and investment opportunities keep renting relevant, especially for mobile and younger populations.

Ultimately, your decision should align with your financial goals, lifestyle, and market conditions. Use data, stay informed, and think long-term.

Comments