How Inflation and Interest Rates Impact Different Industries. Why the Same Economic Change Hurts Some Businesses and Helps Others

- Editor

- Dec 17, 2025

- 3 min read

Inflation and interest rates are two of the most powerful forces in the economy. They influence everything from the price of groceries to stock market valuations. Yet, one of the most misunderstood aspects of these forces is this:

Inflation and interest rate changes do not impact all industries equally.

While some sectors struggle under rising rates and costs, others quietly benefit. Understanding this difference is essential for interpreting markets, business performance, and long-term investment trends.

Inflation and Interest Rates: The Starting Point

Inflation refers to the rise in prices of goods and services over time. When inflation rises sharply, central banks step in by increasing interest rates to slow down spending and borrowing.

This cycle played out globally between 2021 and 2023, when post-COVID supply disruptions and strong demand pushed inflation to multi-decade highs. In response, central banks across the world including the US Federal Reserve, ECB, and RBI interest rates aggressively.

Inflation Interest Rate Relationship

These visuals explain why central banks tighten policy when inflation rises.

Banking & Financial Services: Often the Early Beneficiaries

Banks are among the first industries to react to interest rate changes. When interest rates rise, banks can often increase lending rates faster than deposit rates, leading to improved net interest margins (NIMs).

For example, during the 2022-2023 rate hike cycle, many global and Indian banks reported stronger margins despite slower credit growth. In India, large private banks benefited from higher yields on loans, even as borrowing costs rose for customers.

However, if rates rise too fast or stay high for too long, loan growth can slow and asset quality risks increase showing that even beneficiaries face limits.

How Interest Rates Affect Banks

Real Estate & Infrastructure: Highly Sensitive to Rates

Few industries feel the impact of interest rates as directly as real estate. Higher rates increase EMIs, making home loans more expensive and reducing affordability.

Globally, rising rates in 2022 led to a slowdown in housing markets across the US, Europe, and parts of Asia. In India, while demand remained resilient in premium segments, affordability pressures were visible in price-sensitive housing categories.

Infrastructure companies are also affected, as large projects rely heavily on debt. Higher borrowing costs can delay projects or reduce profitability.

Interest Rates vs Real Estate

Consumer Staples: Inflation Resilient by Nature

Companies selling essential goods food, beverages, household products are often more resilient during inflationary periods. Demand for necessities tends to remain stable even when prices rise.

However, inflation still creates challenges. Input costs such as raw materials, packaging, and transportation increase. The key question becomes pricing power can companies pass on higher costs to consumers without hurting volumes?

Global FMCG companies and Indian consumer staples firms have repeatedly shown that strong brands are better positioned to protect margins during inflationary phases.

Pricing Power & Inflation

Consumer Discretionary: The First Casualty of Tightening

Discretionary sectors such as automobiles, travel, luxury goods, and consumer durables often feel the pressure early when inflation rises and interest rates increase.

Higher EMIs, fuel costs, and food prices reduce disposable income, leading consumers to postpone non-essential spending. This pattern was visible globally in 2022, as demand for discretionary goods softened across markets.

However, premium brands with aspirational value often show better resilience than mass-market players.

Inflation Impact on Consumer Spending

Technology & Growth Stocks: Valuation Takes the Hit

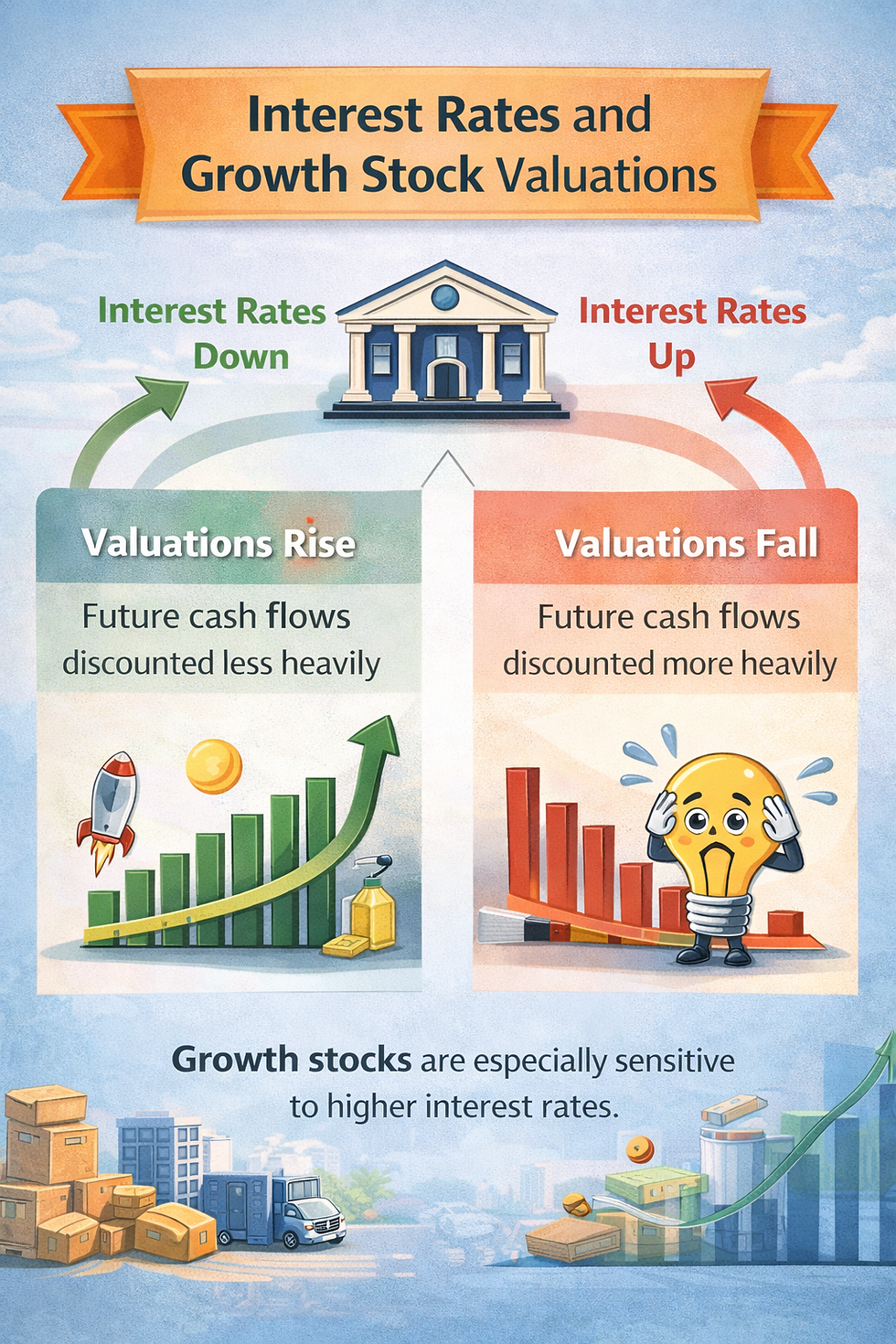

Technology and high-growth companies are particularly sensitive to interest rates not because their businesses deteriorate overnight, but because their valuations are based on future earnings.

When interest rates rise, future cash flows are discounted more heavily, leading to valuation compression. This was clearly seen in global tech stocks during 2022, when many companies saw sharp price corrections despite steady revenues.

This does not mean technology becomes irrelevant but it shows why rate cycles matter deeply for growth oriented sectors.

Interest Rates and Growth Stock Valuations

Why Markets React Before Data Changes

One critical insight is that markets anticipate inflation and interest rate changes. Stock prices often move months before official data reflects economic stress or recovery.

This is why:

Markets fell sharply in 2022 before earnings weakened

Markets recovered in late 2023 even as rates remained high

Investor expectations, not just data, drive price movements.

Inflation and interest rates are not just economic statistics they reshape business economics across industries. While banks and commodity producers may benefit, rate sensitive and discretionary sectors often face pressure.

Understanding these differences helps explain market behaviour, sector rotations, and valuation changes across cycles. More importantly, it encourages a broader, more strategic view of markets, beyond short term noise.

In the end, inflation and interest rates don’t just change prices they change priorities, behaviour, and opportunity.

Comments