Supply Chain Finance and Global Trade Risks: A Business Owner’s Guide

- Editor

- Sep 9

- 4 min read

by KarNivesh | 09 September, 2025

In today’s interconnected global economy, businesses operate in a world of both immense opportunity and rising uncertainty. While international trade has become more accessible than ever, managing cash flows, payment cycles, and geopolitical risks has grown increasingly complex. One solution gaining momentum is Supply Chain Finance (SCF), which helps businesses stabilize working capital and manage risks in global trade. At the same time, entrepreneurs must also recognize that trade in 2025 faces significant disruptions, making it vital to balance opportunity with careful risk management.

What is Supply Chain Finance?

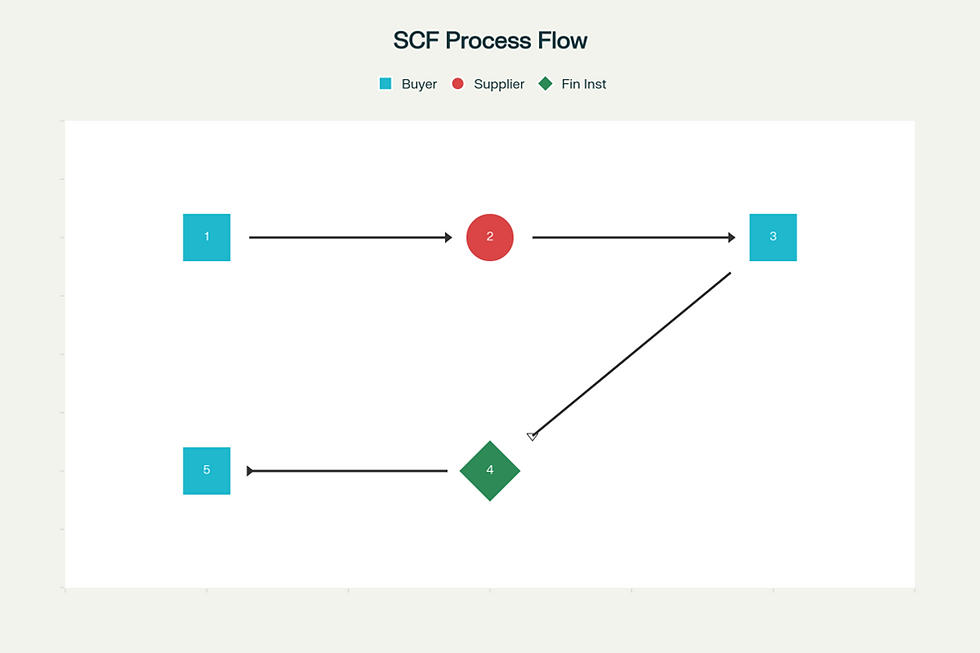

Supply Chain Finance is essentially a financial arrangement that improves cash flow between buyers and suppliers. It acts as a bridge to solve one of the biggest challenges businesses face the gap between paying suppliers and receiving payments from customers.

Here’s how it works: suppliers can get paid early through a financial institution or SCF platform, while buyers can enjoy extended payment terms. The financier earns a small fee in return. This creates a win-win situation suppliers get liquidity, buyers have more breathing room, and financiers manage relatively low-risk transactions.

For example, instead of waiting 60–90 days for payment, suppliers can receive cash immediately, minus a small discount (usually 1–3% annually). This allows them to reinvest in operations and growth rather than being stuck in a cash crunch.

Why SCF Matters for SMEs

Small and Medium Enterprises (SMEs) form the backbone of economies worldwide. In India alone, there are over 74 million SMEs, yet they face a massive ₹31,75,61,600 crore (₹31.75 trillion) global credit gap, making financing one of their greatest challenges.

Take the case of a textile manufacturer in Gujarat supplying fabrics to a large retail chain. Traditionally, the supplier waited up to 90 days to get paid, straining working capital. With SCF, payments became immediate. Instead of waiting for ₹88.19 lakh (₹8.819 million), the manufacturer now receives ₹86.42 lakh (₹8.642 million) instantly, paying only ₹1.76 lakh (₹176,000) in financing fees. Within a year, the company expanded its workforce by 20% and increased production by 25%.

This example highlights SCF’s ability to empower SMEs by improving cash flow, lowering financing costs, and strengthening supplier-buyer relationships.

India’s SCF Market: Growth and Opportunities

The Indian SCF market is experiencing remarkable growth, driven by digitization, government support, and rising awareness. The market was valued at:

2024: ₹35,582 crore (₹3,55,820 million)

2025: ₹39,545 crore (₹3,95,450 million)

2035 (projected): ₹1,14,387 crore (₹11,43,870 million)

With a CAGR of 11.14%, SCF is one of India’s fastest-growing financial service segments.

The government has also supported SCF through initiatives like TReDS (Trade Receivables Discounting System), which has processed over ₹2,00,000 crore worth of MSME invoices and onboarded 44,000+ MSMEs.

Leading platforms such as Mynd Fintech (₹374 crore monthly throughput), CredAble, Vayana Network, and CashFlo are driving innovation and adoption across industries.

Global Trade Risks in 2025

Despite the benefits of SCF, businesses must contend with a challenging global trade environment. According to risk assessments, the top threats in 2025 include:

Geopolitical Conflicts (23%) – Ongoing conflicts, such as tensions in the Red Sea, have forced ships to reroute via Africa, raising shipping costs by 15–25%.

Trade Wars and Tariffs (18%) – Tariffs on certain routes have jumped from 11% to 35%, reshaping global trade flows.

Supply Chain Fragmentation (16%) – Companies are “de-risking” by diversifying supply bases, increasing costs.

Climate Change (14%) – Extreme weather events are disrupting manufacturing and logistics worldwide.

These risks directly impact SCF by increasing financing costs, adding compliance burdens, and amplifying currency volatility.

Technology is Transforming SCF

Amid these challenges, technology is making SCF smarter and more efficient.

Blockchain: Projected to reach ₹61,733 crore (₹617.33 billion) in SCF applications by 2028, blockchain ensures transparency, reduces fraud, and enables smart contracts that automate payments.

Digital Platforms: AI and cloud-based SCF platforms now process approvals in 2–4 hours (versus 5–10 days traditionally) and reduce operational costs by up to 50%. These savings are passed on as lower fees.

Such innovations are making SCF accessible to businesses of all sizes, especially SMEs that were previously excluded from formal financing systems.

Industry Applications

SCF is widely used across industries:

Automotive & Manufacturing: Large firms manage extensive supplier networks through SCF, improving resilience.

Retail & FMCG: Suppliers get liquidity to scale up production during festive seasons and maintain inventory.

Healthcare & Pharma: SCF ensures uninterrupted supply of critical medicines and equipment.

Each sector benefits from reduced working capital needs, improved supplier stability, and stronger supply chain relationships.

The Future of SCF

Looking ahead, the SCF industry is set for robust expansion:

Global Market: From ₹66,139 crore (₹661.39 billion) in 2025 to ₹1,34,041 crore (₹1.34 trillion) by 2035.

Indian Market: Projected to reach ₹1,14,387 crore (₹11.43 trillion) by 2035.

Emerging trends include ESG-linked financing, where sustainable suppliers receive better rates, embedded finance integrated into ERP systems, and AI-driven credit scoring for underserved businesses.

Conclusion

Supply Chain Finance is more than just a financial tool it is a lifeline for businesses navigating today’s uncertain trade landscape. By bridging cash flow gaps, lowering financing costs, and enabling resilience, SCF allows companies especially SMEs to grow sustainably.

India’s SCF market demonstrates this potential, with exponential growth projected over the next decade. However, businesses must also stay alert to global risks, from geopolitical conflicts to climate disruptions. Success lies in combining SCF adoption with risk management strategies and leveraging technology for efficiency and transparency.

The future of trade belongs to businesses that can balance opportunity with caution. By embracing Supply Chain Finance and preparing for global trade risks, entrepreneurs can position themselves to thrive in an interconnected but volatile world.

Comments