Should You Pay Off Your Student Loan Quickly or Invest? A Simple Guide for Everyone

- Editor

- Aug 22

- 4 min read

by KarNivesh | 22 August, 2025

For many young Indians, student loans are the ticket to quality education and better career opportunities. But once you graduate and start earning, a big question arises: Should I pay off my education loan as quickly as possible, or should I start investing my money instead?

It’s a dilemma almost every graduate faces, and the answer isn’t the same for everyone. It depends on things like your loan interest rate, career growth, financial goals, and even your comfort with taking risks. Let’s break it down in simple terms so you can make the right choice for yourself.

The Education Loan Scene in India

Education is expensive, and costs are rising faster than normal inflation. That’s why loans have become a lifeline for many families. Right now, education loans in India usually carry interest rates between 8% and 12%. Some loans go higher if they’re without collateral or for less well-known institutes.

There’s also one big benefit: tax savings under Section 80E of the Income Tax Act. For up to 8 years, you can deduct the entire interest paid on your education loan from your taxable income. This reduces your “real” cost of borrowing. For example, if your loan rate is 10% and you’re in the 30% tax bracket, the effective cost drops to about 7%.

So, loans are expensive—but not as heavy as they look once tax benefits kick in.

Why You Might Want to Pay Off Quickly

For many people, being debt-free is a huge relief. Here’s why paying off fast makes sense:

Guaranteed returns: If your loan rate is 10%, every rupee you repay saves you 10% interest. That’s like earning a guaranteed 10% return—something no investment can promise without risk.

Peace of mind: Loans can be stressful. Paying them off early frees you from monthly EMI anxiety. Many people feel lighter, more focused, and more motivated once they’re debt-free.

Flexibility: Without debt, you can take career risks like starting a business, switching jobs, or pursuing passion projects without worrying about EMIs.

Preparedness for tough times: During uncertain times—like the pandemic—those with heavy loans struggled more. Paying off quickly reduces this financial vulnerability.

Why You Might Want to Invest Instead

On the flip side, investing instead of rushing to repay can sometimes make better financial sense. Here’s why:

Higher returns than loan interest: Historically, the stock market (Nifty 50) has delivered about 11–12% per year. If your loan rate is below that (say 8–9%), investing could grow your wealth faster than repaying.

The power of compounding: The earlier you start investing, the more your money multiplies over time. Even small monthly amounts can grow into large sums if given enough years.

Inflation advantage: Over time, inflation reduces the “real value” of your loan. What feels like a big amount today may not feel as heavy ten years later because your income and prices will likely rise.

Wealth creation: Investments help you build assets—something loan repayment alone can’t do.

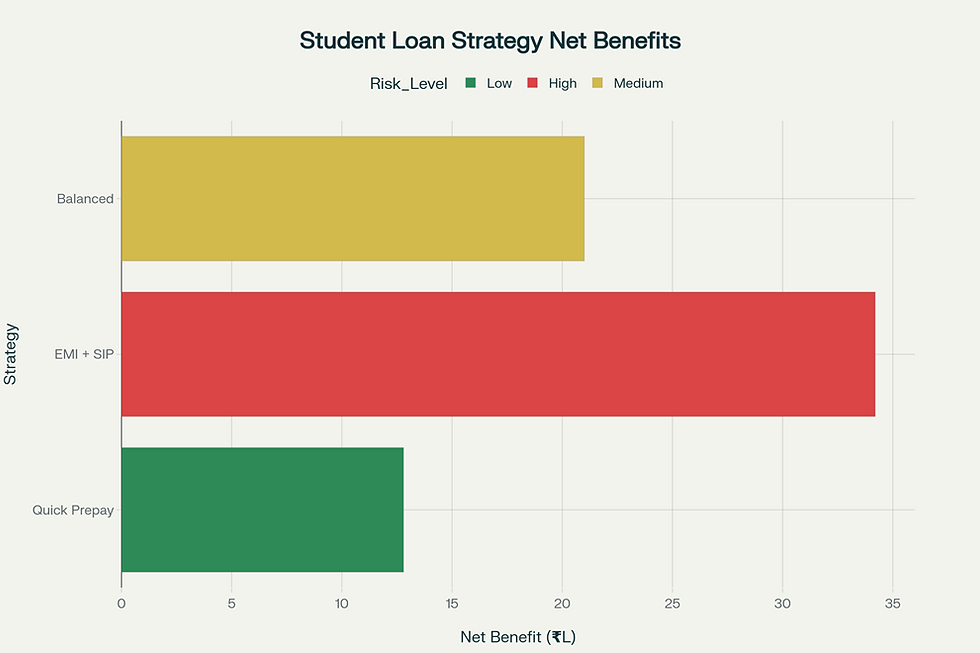

The Balanced Middle Path

For most people, the smartest choice isn’t choosing one extreme but doing both together. Here’s what that looks like:

Use part of your extra income to make some prepayments and reduce your loan.

Invest the rest regularly (through SIPs in mutual funds, for example).

This way, you’re reducing your debt burden while also creating wealth. Many financial planners suggest splitting it roughly 50-50 or adjusting the ratio based on your comfort with risk.

Things to Consider Before Deciding

When you’re trying to decide, here are the key questions to ask yourself:

What’s my loan interest rate?

Above 12% → Better to repay quickly.

Between 10–12% → Balanced approach may work.

Below 10% (especially after tax benefits) → Investing could be more rewarding.

What’s my career path?If your income is expected to grow steadily (like in tech or finance), you can take on some investment risk. If your income is uncertain, debt repayment may be safer.

How comfortable am I with risk?Some people can handle market ups and downs, others can’t sleep at night if their investments fall. Be honest with yourself—peace of mind matters.

Do I have an emergency fund?Before anything, set aside 6–12 months of living expenses in a safe place (like a savings account or FD). This protects you during job loss or emergencies.

What stage of life am I in?Younger people have time to invest and let money grow. Those nearing big expenses like marriage or buying a house may prefer to clear loans sooner.

How to Put Your Plan into Action

If you want to repay quickly:

Pay extra whenever you get bonuses or salary hikes.

Focus first on loans with the highest interest.

Keep at least a small emergency fund aside.

If you want to invest more:

Start SIPs in mutual funds (equity for long term, debt for safer returns).

Stay consistent and don’t stop investments during market dips.

Review your portfolio once a year.

If you want a mix:

Divide extra money between prepayment and investments.

Review your balance every 6–12 months and adjust as needed.

Common Mistakes to Avoid

Skipping an emergency fund: Don’t put all your money into either repayment or investing without keeping a safety net.

Ignoring tax benefits: Always claim the Section 80E deduction—it makes a big difference.

Overestimating returns: Stock markets can fall. Don’t assume you’ll always beat loan interest rates.

Making emotional decisions: Balance peace of mind with numbers. Don’t just follow friends—your situation is unique.

Final Thoughts

There’s no one-size-fits-all answer to the “loan vs. invest” question. For some, the joy of being debt-free outweighs any financial logic. For others, the thrill of wealth creation through investments is worth the risk.

But here’s the key: do something. Don’t stay stuck worrying about the perfect strategy. Whether you choose repayment, investment, or a mix of both, what matters most is consistency and long-term commitment.

And remember—you can always adjust your approach as your income grows, goals change, or markets shift. The best strategy is the one that keeps you financially secure, stress-free, and moving steadily toward your dreams.

Comments