Mutual Funds vs. Direct Equity: Which is Better for Indian Investors?

- Editor

- Aug 29

- 5 min read

by KarNivesh | 29 August, 2025

When it comes to growing your money, two popular choices often come up: Mutual Funds and Direct Equity (stocks). Both have their own strengths, risks, and requirements, and understanding the difference between them is very important before deciding where to invest. This blog will break down the report’s findings in simple language, so even if you’re new to investing, you’ll understand how these two options work.

What Are Mutual Funds?

Think of a mutual fund as a money pool. Many people put their money together in this pool, and a professional fund manager uses that pool to invest in different stocks, bonds, or other securities. When you invest in a mutual fund, you don’t buy the stocks directly; instead, you buy “units” of the fund, which represent your share in the overall pool.

One of the best things about mutual funds in India is how affordable they are. You can start with as little as ₹100 for a lump sum or ₹500 for a monthly SIP (Systematic Investment Plan). That makes it possible for anyone—students, young professionals, or retirees—to start investing without needing lakhs of rupees.

The real advantage here is professional management. Experts handle the buying, selling, and research work for you. These managers watch the markets, study companies, and adjust the portfolio to balance risk and return. So, mutual funds are like a “ready-made thali” in a restaurant—you get a balanced plate without worrying about the recipe.

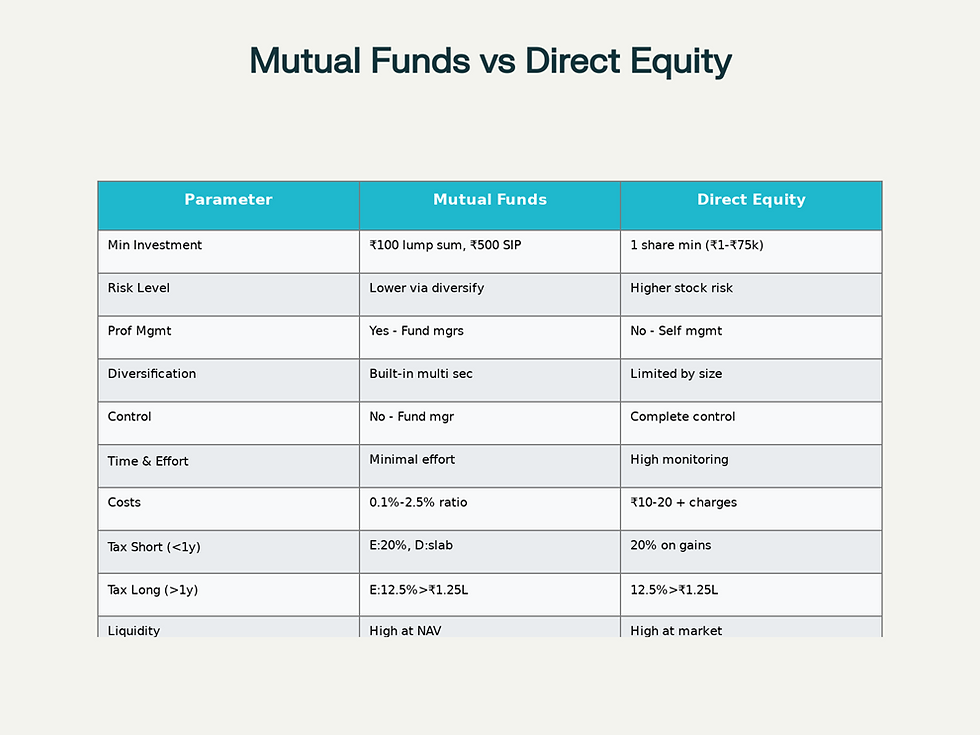

Comprehensive comparison between Mutual Funds and Direct Equity Investment in India

What Is Direct Equity?

Direct equity means buying stocks of companies directly from the stock market. Here, you actually become a part-owner of the company. You can vote in shareholder meetings, and you benefit when the company grows.

The biggest attraction of direct equity is flexibility. You can start with as little as ₹10 if the stock price is that low, or spend lakhs if you want. There’s no fixed minimum. You also have complete control: you decide which company to invest in, when to buy, and when to sell.

But here’s the catch—it takes a lot of time, research, and knowledge. You need to understand company financials, industry trends, and market conditions. You can’t just buy and forget; you have to track your stocks regularly. Think of direct equity as “cooking your own meal”—you have the freedom to choose the ingredients, but you also take on the full responsibility of whether it turns out delicious or disastrous.

Risk and Returns

Here’s where things get interesting.

Mutual Funds spread out your money across many stocks and sectors. So, if one company does badly, it won’t hurt you too much because other companies in the portfolio balance it out. This makes mutual funds less risky.

Direct Equity, on the other hand, can give you higher returns but also carries higher risk. If you pick the right stock, you can earn great profits. But if you pick the wrong one, your portfolio can take a big hit.

For example, the report shows that over 10 years, ₹1,00,000 invested in mutual funds could grow to around ₹2.7 lakh, while direct equity could grow to ₹3.8 lakh. The catch? This higher return from stocks assumes you consistently make smart decisions, which is tough for most individual investors.

Costs Involved

Every investment has costs, and it’s important to know them.

Mutual Funds charge an expense ratio (0.1% to 2.5%) for fund management. This fee covers the manager’s salary, research costs, and administration. Some funds also have an exit load (around 1%) if you sell too soon.

Direct Equity involves brokerage fees (₹10–20 per trade) plus taxes like STT and stamp duty. On paper, this looks cheaper, but the hidden cost is your time, effort, and the risk of making mistakes.

So, mutual funds are like paying a chef to cook for you, while direct equity is like cooking yourself—you save on chef fees but must spend time, effort, and face the risk of messing up.

Tax Rules

Both mutual funds and direct equity now follow similar tax rules in India:

Short-term (less than 12 months): 20% tax on gains.

Long-term (more than 12 months): Gains up to ₹1.25 lakh are tax-free; above that, you pay 12.5%.

This uniform tax treatment means your choice should depend more on your goals and risk appetite than on tax differences.

Convenience and Management

If you’re a busy professional who doesn’t have hours to study the market, mutual funds are a lifesaver. You can invest once and let experts handle everything. SIPs even automate your monthly investments, making it a hassle-free option.

Direct equity, however, is for people who enjoy the process of researching, analyzing, and actively managing their investments. It demands time and patience.

Liquidity and Flexibility

Both mutual funds and direct equity are liquid, meaning you can get your money back when needed.

Mutual funds take 1–3 business days to process redemption (except liquid funds, which are faster).

Direct equity gives instant liquidity during market hours—you can sell stocks immediately at the current market price.

However, during market volatility, selling a stock at your desired price may not always be possible.

Who Should Choose What?

The report makes it clear:

Beginners → Mutual Funds are the best starting point. They teach discipline, reduce risk, and require less knowledge.

Experienced Investors → Direct equity works if you have the skills, time, and patience. Many experienced investors also follow a hybrid strategy: putting most money in mutual funds for stability, while keeping a small portion in stocks for higher returns.

Risk-Averse Investors → Mutual funds are safer because of diversification.

Risk-Taking Investors → Direct equity can give big rewards but comes with the chance of big losses too.

Current Market Situation

In 2025, Indian stock markets are doing well, with the Nifty 50 and Sensex bouncing back strongly. Foreign investors are returning, and the government’s focus on infrastructure is boosting market confidence.

This trend benefits both mutual fund investors and stock pickers. However, mutual funds may have an edge because they can capture broad market growth without relying on a few stock choices.

Technology and Access

Thanks to apps and online platforms, investing is easier than ever.

Mutual funds now come with tools like robo-advisors that suggest funds based on your goals.

Stock market platforms provide real-time data and research tools, though beginners may find the information overwhelming.

So, technology has opened doors for everyone, but the responsibility still lies with how you use it.

Final Thoughts

The choice between mutual funds and direct equity isn’t about which is “better” universally—it’s about which is better for you.

If you’re just starting out, mutual funds through SIPs are a solid way to build wealth steadily.

If you’re knowledgeable, confident, and ready to put in the work, direct equity can give you higher returns.

For most investors, a combination of both works best—say 70–80% in mutual funds and 20–30% in stocks.

Remember, investing success is more about patience and consistency than timing the market. As the report wisely points out:It’s better to spend time in the market than trying to time the market.

Comments