How Generative AI is Revolutionizing Banking in India?

- Editor

- Sep 5

- 4 min read

by KarNivesh | 05 September, 2025

Imagine walking into your bank and talking to an assistant that knows your financial history, helps you apply for loans, detects fraud before it happens, and provides personalized investment advice all in real-time. This is no longer science fiction. Generative Artificial Intelligence (AI) is already reshaping how banks operate, and the pace of change is faster than most people realize.

This blog explores how generative AI is transforming the banking sector, what it means for everyday customers, and why it represents opportunities worth thousands of crores in India.

What is Generative AI and Why It Matters ?

Generative AI is a branch of artificial intelligence that creates new content whether text, images, or even financial reports based on what it has learned. Unlike traditional banking software that follows fixed rules, generative AI understands context, engages in natural conversations, and makes intelligent decisions.

Think of it as a banking assistant that never sleeps, can handle thousands of queries at once, and becomes smarter with every interaction. For banks, this means improved efficiency; for customers, it means faster, more personalized services.

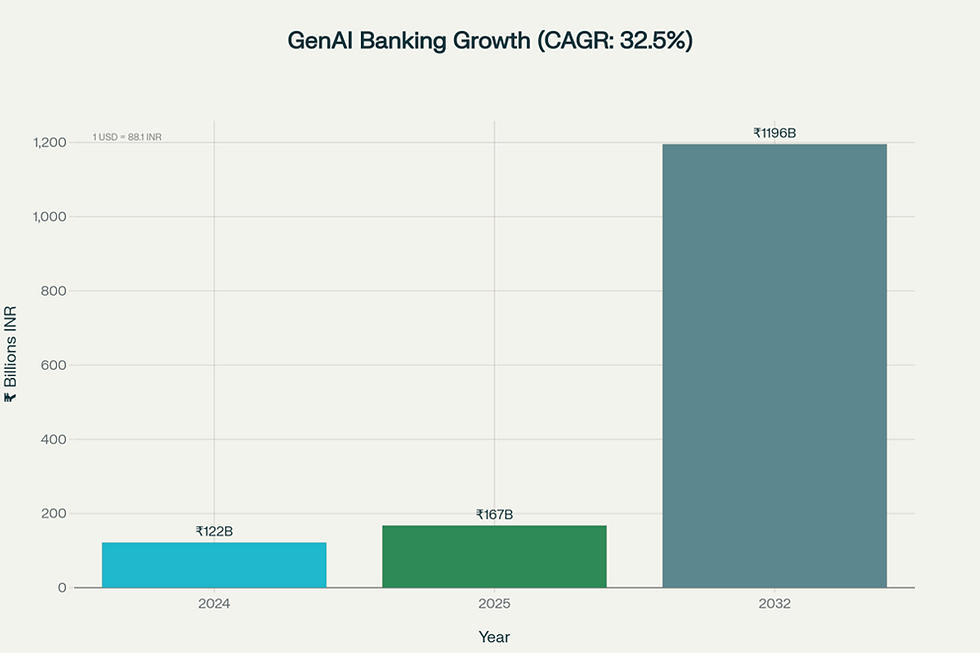

The Numbers Behind the AI Boom

The global generative AI market in banking and financial services is witnessing explosive growth. In 2024, it stood at ₹121.58 billion and is projected to soar to ₹1,195.52 billion by 2032 a nearly 10-fold increase in just eight years. This represents a staggering compound annual growth rate (CAGR) of 32.5%.

The investments are equally massive. JP Morgan, for example, is spending about ₹1,497.7 billion on AI in 2024 alone, while the global financial sector as a whole is expected to invest around ₹8,545.7 billion by 2027. Clearly, AI is no longer a futuristic experiment it’s a multi-trillion-rupee industry reshaping finance.

Why Banks Are Betting Big on AI ?

Banks aren’t investing these sums just for the hype. The return on investment (ROI) is impressive. Financial services lead all industries in ROI from generative AI, averaging 4.2 times the original investment. Simply put, for every ₹1 banks invest, they get back ₹4.20 in value.

Even more striking, 90% of banks using AI are reporting revenue growth of at least 6%. Looking ahead to 2026, each front-office banking employee supported by AI is expected to generate an additional ₹30.83 crore in revenue. These are not abstract numbers they reflect real gains in productivity, efficiency, and customer satisfaction.

Real Success Stories in Indian Banking

SBI: Implementing agentic AI that acts like a digital relationship manager, handling customer queries and transactions independently.

HDFC Bank: Uses AI beyond chatbots for risk management, customer behavior prediction, and retention.

ICICI Bank: Employs AI for voice-enabled banking, fraud detection, and personalized financial services.

Axis Bank: Uses AI to predict customer churn and proactively retain clients.

Hidden Benefits for Customers

Faster Service – Routine banking queries are resolved instantly.

Personalized Experience – AI tailors banking solutions to individual needs.

Enhanced Security – Real-time fraud detection ensures safer transactions.

Lower Costs – Efficiency gains reduce service charges and improve interest rates.

Financial Inclusion – AI helps assess creditworthiness for individuals without a traditional credit history, expanding access to loans and financial services.

Challenges That Remain

Despite its benefits, AI adoption in banking faces hurdles:

Data Security & Privacy – Banks must safeguard sensitive data and comply with laws like India’s Personal Data Protection Act.

Skill Gaps – Employees need training in both finance and AI.

Regulatory Compliance – Financial regulators must ensure AI tools are transparent and compliant.

Customer Trust – Many people remain skeptical of machines managing their finances.

What the Future Holds ?

Hyper-Personalization – AI will deliver customized advice in real-time.

Voice Banking – Natural language voice assistants will make banking even more seamless.

Predictive Banking – AI will anticipate needs, such as suggesting loans during home searches or recommending investments during market dips.

Automated Financial Planning – AI advisors will build and adjust financial plans dynamically, based on life events.

The Impact on India’s Economy

The McKinsey Global Institute estimates generative AI could add between ₹17,620 billion and ₹29,954 billion annually to the global banking industry. For India, this means more tech jobs, deeper financial inclusion, and an opportunity to lead in fintech innovation. Rural and underserved populations, in particular, stand to gain from AI-driven services.

Preparing for an AI-Powered Future

For Consumers: Stay informed about AI-enabled banking features, embrace digital literacy, and monitor your data-sharing preferences.

For Professionals: Build AI literacy, upskill in data and customer experience, and strengthen uniquely human skills like creativity and empathy.

Generative AI is not just an upgrade to banking it’s a revolution. From a ₹121.58 billion market today to a projected ₹1,195.52 billion by 2032, the technology is driving one of the biggest transformations in financial services history.

The benefits faster services, stronger security, and financial inclusion are already visible. While challenges in trust, privacy, and regulation remain, the momentum is unstoppable. For customers, this means smarter, safer, and more personalized banking. For India, it represents a path toward global fintech leadership.

The future of banking is intelligent, responsive, and customer-first. And with generative AI leading the charge, it’s a future we can all bank on.

Comments