Gold vs. Bitcoin: The Battle of Alternative Assets in 2025

- Editor

- Aug 19

- 4 min read

by KarNivesh | 19 August, 2025

The global investment landscape has undergone a remarkable transformation over the past few years. Traditional assets such as stocks and bonds, once considered reliable for wealth creation, no longer provide the same stability and returns as before. Rising inflation, global debt burdens, and geopolitical uncertainties have pushed investors to seek alternative assets that can safeguard their wealth while offering long-term potential.

At the forefront of this shift are gold, the age-old store of value, and Bitcoin, the revolutionary digital asset. While both serve as hedges against inflation and currency debasement, they differ in volatility, risk, and adoption. Understanding their unique roles is crucial for investors crafting resilient portfolios in 2025.

Gold: The Timeless Store of Value

Gold’s reputation as a safe haven stretches back over 5,000 years. It has outlasted empires, currency collapses, and countless economic cycles, proving its ability to preserve purchasing power across generations. Unlike paper money, gold cannot be printed, giving it intrinsic value backed by scarcity and universal acceptance.

Performance and Market Position

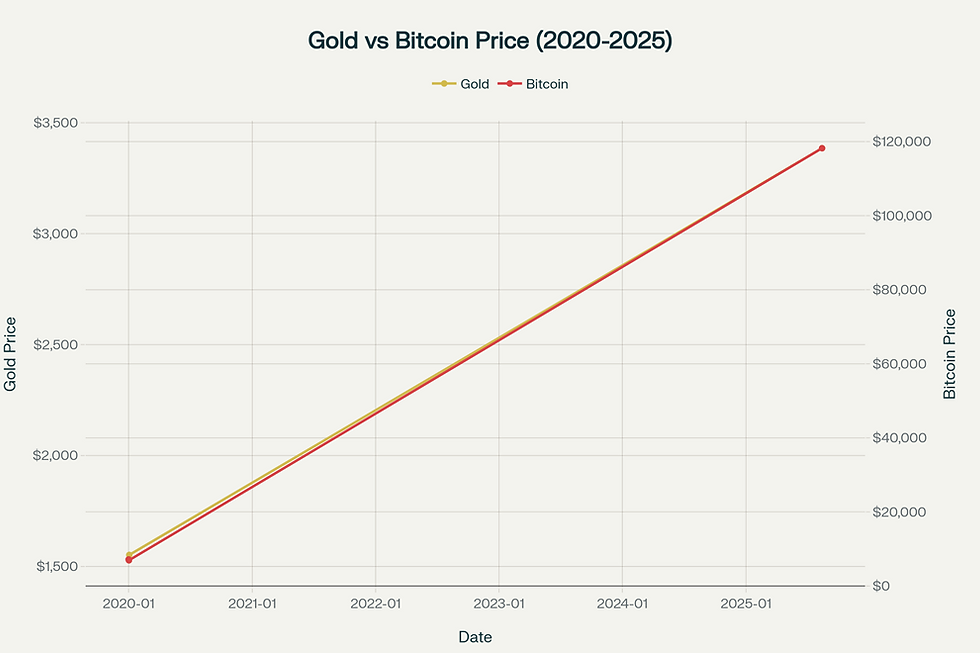

Over the past 20 years, gold has delivered an average annual return of 10%, underlining its steady growth potential. From 2020 to 2025, it gained 121.5%, reaching record highs of ₹2.90 lakh per 10 grams (equivalent to $3,500 per ounce) in 2025. Analysts project further upside, with expectations of ₹3.05 lakh per 10 grams ($3,675/oz) by late 2025 and potentially ₹3.32 lakh per 10 grams ($4,000/oz) by 2026. Long-term forecasts even suggest gold could reach ₹4.27 lakh per 10 grams ($5,155/oz) by 2030.

Why Investors Trust Gold

Low Volatility: With an annualized volatility of just 16.4%, gold offers stability, especially in uncertain times.

Institutional Trust: Central banks purchased more than 1,000 metric tons annually in recent years—double the average of the past decade. This shows that gold continues to be a cornerstone of global financial reserves.

Diversified Demand: Gold’s value is supported by jewelry demand (50%), industrial applications (10%), and investment demand (40%).

Drawbacks of Gold

While gold’s stability is its strength, it comes with certain limitations:

Storage Costs: Owning physical gold requires secure storage, insurance, and handling costs.

Modest Growth: Compared to riskier assets like Bitcoin, gold’s growth is relatively slower.

Government Risk: Historically, governments have confiscated gold in times of crisis (e.g., the U.S. in 1933).

Bitcoin: The Digital Gold Revolution

In stark contrast to gold’s ancient history, Bitcoin is barely 15 years old. Yet, in this short span, it has become a symbol of digital innovation and financial freedom. Built on blockchain technology, Bitcoin introduced the idea of digital scarcity, with a hard cap of 21 million coins.

Performance and Market Position

From 2020 to 2025, Bitcoin delivered mind-blowing returns of 1,547.8%, skyrocketing from a few lakhs per coin to over ₹1.90 crore ($230,000) in 2025. For comparison, gold’s gains during the same period were only 121.5%.

Bitcoin’s supply is further tightened by halving events that occur every four years. The latest, in April 2024, reduced mining rewards from 6.25 to 3.125 Bitcoin, fueling expectations of future price surges.

Why Investors Choose Bitcoin

Scarcity by Design: With only 21 million coins ever, Bitcoin is even scarcer than gold.

Borderless & Digital: It can be transferred globally within minutes, without banks or intermediaries.

High Growth Potential: Despite volatility, long-term returns have been unmatched, with a 3,700% inflation-adjusted return (2012–2022).

Institutional Adoption: Since the approval of Bitcoin ETFs in 2024, global inflows have crossed ₹13.3 lakh crore ($160 billion), with giants like BlackRock, MicroStrategy, and Tesla investing heavily.

Risks of Bitcoin

High Volatility: With annualized volatility at 52.6%, Bitcoin is more than three times as volatile as gold.

Severe Price Swings: Past bear markets have seen drops of 70–80%.

Uncertain Regulation: Governments may tighten rules, raising risks for investors.

Security Issues: Holding Bitcoin requires technical knowledge and careful custody of private keys.

Gold vs. Bitcoin: Head-to-Head

Factor | Gold | Bitcoin |

Market Size | ₹1,162 lakh crore ($14 trillion) | ₹190 lakh crore ($2.3 trillion) |

Volatility | 16.4% | 52.6% |

Institutional Adoption | Widely trusted by central banks | Increasing but not yet in reserves |

Liquidity | Universally accepted | Growing but fragmented |

Growth Potential | Moderate | Very high |

Both assets diversify portfolios as they have low correlation with stocks and bonds. However, their crisis performance differs—gold almost always shines in downturns, while Bitcoin sometimes behaves like a high-risk tech stock.

Portfolio Strategies: Striking the Balance

Financial experts increasingly recommend holding both gold and Bitcoin in modern portfolios.

For Conservative Investors: 4–7% allocation to gold can preserve wealth and hedge against inflation.

For Growth Seekers: 1–5% allocation to Bitcoin provides exposure to upside potential without overexposing to risk.

Blended Approach: Combining both offers stability plus growth. Rebalancing quarterly helps control Bitcoin’s volatility, while gold provides a safety anchor.

Professional managers often fund gold from fixed income allocations and Bitcoin from equity allocations, aligning with each asset’s risk profile.

What Lies Ahead?

Looking into the future, both assets face unique tailwinds:

Gold is supported by central bank purchases, persistent inflation, and geopolitical uncertainty. Its role as a safe haven is unlikely to fade.

Bitcoin benefits from growing institutional adoption, technological upgrades (like Lightning Network), and increasing recognition as “digital gold.”

However, risks remain. Gold faces opportunity costs when interest rates rise, while Bitcoin’s uncertain regulation and environmental concerns continue to spark debate.

Conclusion: Not Gold vs. Bitcoin, but Gold and Bitcoin

The debate between gold and Bitcoin is less about choosing one over the other and more about understanding how both fit into a modern portfolio.

Gold represents timeless security, trusted by civilizations and central banks alike.

Bitcoin embodies digital innovation, offering asymmetric returns for those willing to take on volatility.

By holding both in thoughtful proportions, investors can balance gold’s stability with Bitcoin’s growth, creating a portfolio better prepared for the uncertainties of 2025 and beyond.

In today’s world of inflation, currency debasement, and financial turbulence, the real battle is not between gold and Bitcoin—it’s about how to use both to safeguard and grow wealth in the decades ahead.

Comments