Geopolitical Tensions and Their Impact on Commodity Markets: A 2025

- Editor

- Sep 10

- 4 min read

by KarNivesh | 10 September, 2025

In today’s world, geopolitical tensions are no longer just political events – they are powerful forces shaping global commodity markets. Wars, trade disputes, and export restrictions are creating extreme price volatility, and this is affecting businesses, investors, and consumers worldwide. The report “Geopolitical Tensions and Their Impact on Commodity Markets” gives a detailed picture of how these conflicts ripple through economies.

The Current Situation

As of September 2025, commodity markets are in what experts call a “geopolitical supercycle.” This means political conflicts are influencing prices more than basic supply and demand. Crude oil prices stand at ₹5,527 per barrel (WTI) and ₹5,853 per barrel (Brent). Gold has reached historic highs at ₹3,21,803 per troy ounce.

Research shows that during peak crisis periods, geopolitical risks can increase global inflation by 1.2 percentage points. This explains why prices of daily essentials, energy, and raw materials are at record highs.

Major Conflicts Affecting Commodity Markets

1. Russia-Ukraine War

Since 2022, the war has disrupted supplies of wheat, gas, and fertilizers. Prices of some commodities jumped by 40–60%. Russia and Ukraine together account for 30% of global wheat exports, and disruptions pushed 27.2 million people into poverty and 22.3 million into hunger. Many developing countries, heavily dependent on imported grains, are still struggling.

2. US-China Trade War

Tariffs remain extremely high – the US has placed tariffs of 124% on Chinese goods, while China has retaliated with 147% tariffs on American products. Agricultural commodities are hit the hardest: US soybean exports to China have fallen by 50% and pork by 72%. This forced China to buy from Brazil and Argentina, permanently reshaping global agricultural trade flows.

3. China’s Rare Earth Restrictions

In 2025, China restricted exports of seven rare earth elements critical for high-tech industries. Prices of some, like dysprosium, tripled to ₹74,985 per kilogram. These elements are essential for electric vehicles, smartphones, wind turbines, and defense technologies. Since China controls 70% of mining and 90% of processing, the world is heavily dependent on its policies.

4. Middle East Tensions

Conflicts between Israel and Iran have added pressure to global oil markets. While prices spiked to ₹6,760 per barrel (equivalent to $81.40) before stabilizing, the Strait of Hormuz – which handles 20% of global oil and gas trade worth about ₹52.86 trillion daily – remains at constant risk. Any serious disruption could push oil to ₹10,593 per barrel.

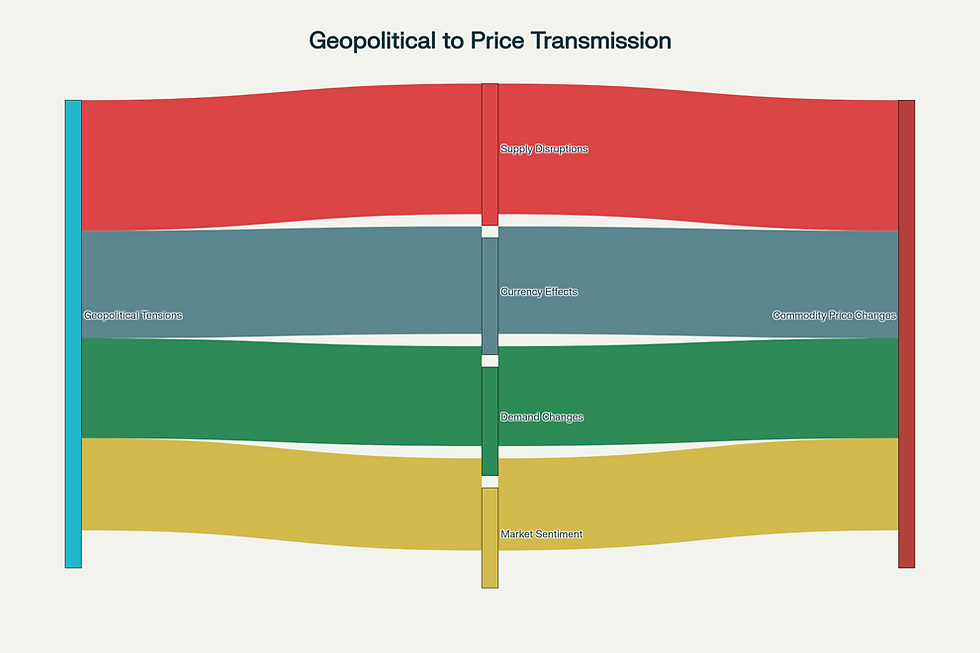

How Geopolitical Tensions Affect Prices

The report highlights four main channels:

Supply disruptions – wars damage infrastructure, sanctions ban exports, and political instability halts production.

Demand-side effects – stockpiling, industrial slowdown, and changing consumer habits.

Currency and finance – strong US dollar, capital flight from emerging markets, and higher risk premiums.

Speculative and psychological factors – fear-driven trading and media amplification increase volatility.

Regional Vulnerability

Asia is the most vulnerable, especially to rare earth dependency (95% reliance on China). Japan and South Korea have already faced factory shutdowns.

Europe faces a 90% energy vulnerability, especially after its heavy reliance on Russian gas backfired.

North America is more secure but still has 85% vulnerability in rare earth supplies due to dependence on China for processing.

Timeline of Major Events

2018-2019 – US-China trade war reshaped agricultural trade.

2020 – COVID-19 exposed supply chain fragility.

2022 – Russia-Ukraine war triggered a global commodity shock.

2023-2025 – Rare earth restrictions, Middle East conflicts, and shipping crises became part of the “new normal.”

Sector-Wise Impacts

Energy – Oil remains the most politically sensitive. Current Brent crude at ₹5,853 per barrel reflects geopolitical premiums. Transition to renewables creates new risks, as critical minerals (lithium, cobalt, nickel) are concentrated in unstable regions.

Agriculture – Wheat prices (₹15,263 per ton) remain elevated due to Ukraine’s reduced output. Climate change worsens these risks.

Metals & Minerals – Copper (₹8,64,305 per ton) and lithium have become strategic commodities for green energy. Rare earths are now considered national security assets.

Economic and Social Consequences

Inflation & Growth – Shocks raise inflation by up to 1.2 percentage points and cut GDP growth by 0.5 points, creating stagflation.

Trade Fragmentation – “Friend-shoring” reduces efficiency as countries trade only with allies.

Poverty & Hunger – Rising food and energy prices have pushed millions into poverty, especially in developing countries.

Adaptation Strategies

Diversification – Companies adopt “China+1” strategies to avoid overdependence.

Technology – AI, satellites, and blockchain are helping monitor supply risks.

Stockpiling – Countries and firms are building reserves of critical commodities like oil, metals, and fertilizers.

Emerging Risks

Taiwan tensions could disrupt semiconductors and rare earth supply chains.

Arctic resources may spark new great-power competition.

African minerals are becoming the next geopolitical battleground.

Climate change will worsen food and water scarcity.

Implications for Stakeholders

Businesses need stronger supply chain resilience and scenario planning.

Investors should price in geopolitical risks, with gold (₹3,21,803 per troy ounce) remaining a safe haven.

Governments must balance energy security with consumer price control, while building international cooperation.

Conclusion

Geopolitical tensions are no longer temporary shocks but permanent features of global markets. Crude oil at ₹5,527–₹5,853 per barrel, gold at ₹3,21,803, and rare earths restricted by China signal a “new normal.”

For businesses, resilience now matters more than efficiency. For investors, geopolitical analysis is as critical as financial analysis. For governments, economic and national security are now inseparable.

The future of commodities will be shaped as much by politics and technology as by economics. Those who prepare for these disruptions will thrive, while others risk being left behind in a world where geopolitical risks define markets.

Comments