Fintech Careers of the Future: Your Gateway to India’s Most Exciting Industry

- Editor

- Sep 1

- 3 min read

by KarNivesh | 01 September, 2025

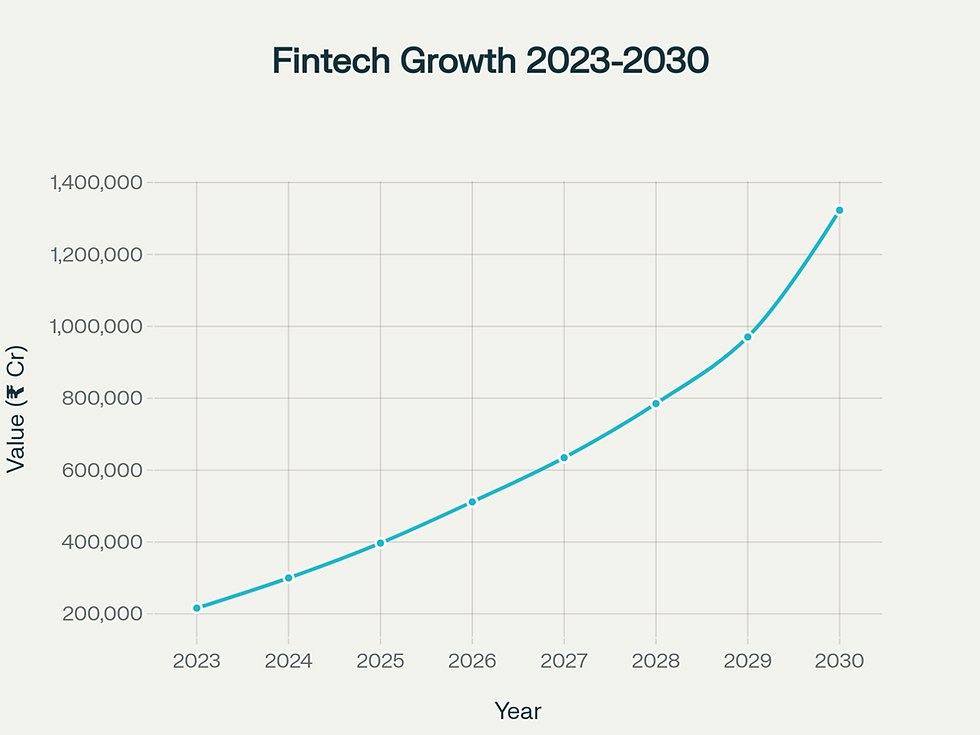

The financial technology (fintech) sector is witnessing explosive growth in India, reshaping how we pay, save, invest, and borrow. What was once a niche industry has now become one of the most dynamic sectors of the economy. With fintech revenues projected to reach ₹13,23,000 crores (₹1.32 trillion) by 2030, the industry is not just creating jobs but entire ecosystems of careers that didn’t exist a decade ago. From blockchain developers earning over ₹1.63 crores annually to data scientists commanding ₹1.18 crores, fintech is proving to be one of the most rewarding and future-proof career paths today.

What is Fintech? Where Money Meets Technology

Fintech is the fusion of finance and technology aimed at making financial services faster, cheaper, and more accessible. Every time you use Paytm to pay a bill, check your savings in a mobile banking app, or invest through Zerodha, you are engaging with fintech. Unlike traditional banking, which depends on branches and paperwork, fintech thrives on digital-first solutions, often delivered directly to your smartphone.

Its beauty lies in diversity covering digital payments, mobile banking, cryptocurrency exchanges, AI-driven investment platforms, and more. This means career opportunities are wide open to computer science graduates, finance professionals, and even those from non-finance backgrounds looking for a career pivot.

The Fintech Boom in India

India has emerged as the third-largest fintech market globally, with more than 7,300 startups and a funding volume of around ₹26,49,000 crores (approx. $30.2 billion). In 2024 alone, fintech employment grew by 7.5%, directly employing 1.8 lakh professionals and indirectly supporting another 2.7 lakh jobs.

Globally, the sector is expected to grow from ₹2,16,090 crores in 2023 to ₹13,23,000 crores by 2030, at a CAGR of 26.2%. This growth signals not only a surge in demand for fintech services but also in career opportunities across domains.

Skills That Will Future-Proof Your Fintech Career

Technical Skills (45%): Python, Java, SQL, blockchain development, AI/ML, cloud computing.

Data & Finance Knowledge (35%): Credit risk analysis, regulatory compliance (RBI, AML, KYC), market understanding.

Soft Skills (20%): Problem-solving, adaptability, and strong communication to explain complex ideas simply.

Breaking Into Fintech

Educational Pathways

Computer Science/Engineering – for tech-heavy roles like blockchain or cybersecurity.

Finance/Economics – for product management and compliance.

Maths/Statistics – for data science and quantitative analysis.

Any Background – with fintech certifications, anyone can transition.

Gaining Practical Experience

Internships: Paid internships (₹15,000–₹20,000 monthly) provide exposure.

Hackathons: Great way to network and showcase skills.

Open Source Projects: Contributing builds credibility.

Personal Projects: Building a fintech app or model demonstrates initiative.

The Remote Work Revolution

Fintech has embraced remote work, creating opportunities beyond major cities. Many companies hire remotely for:

Software Developers: ₹6,30,000 – ₹13,23,000 annually

Data Analysts: Starting at ₹5,95,000

Product Managers: ₹44,10,000 – ₹1,32,30,000 annually

Cybersecurity Experts: With global fintech firms

This makes fintech attractive for professionals in tier-2 and tier-3 cities as well.

Why Now is the Perfect Time

The fintech revolution is just beginning. AI, blockchain, and digital payments are reshaping finance, and India’s government push for digital inclusion is accelerating adoption. With rising internet penetration and global expansion of Indian startups, the demand for skilled professionals will only grow.

Whether you’re a fresh graduate, a career changer, or an experienced professional, fintech offers unmatched opportunities. Beyond high salaries, it allows you to be part of democratizing finance making services accessible to millions previously excluded from formal banking.

The future of finance is digital, decentralized, and data-driven. The question is: are you ready to be part of it?

Comments