BRICS Currency Push – Can it Challenge the US Dollar Dominance?

- Editor

- Aug 19

- 3 min read

by KarNivesh | 19 August, 2025

The dominance of the US Dollar has defined global trade and finance for decades, but a new challenge is emerging from the BRICS bloc—Brazil, Russia, India, China, and South Africa—along with their new members like Egypt, Ethiopia, Iran, UAE, and Indonesia. Together, this group now represents 45% of the world’s population and generates 38% of global GDP (₹59.4 lakh crores or about $68 trillion in PPP terms). With ambitions to reduce reliance on the US Dollar, BRICS is building alternative payment systems, promoting local currency trade, and strengthening financial institutions that could gradually shift the global economic balance.

Understanding BRICS’ Rise

Initially a loose forum of emerging economies, BRICS has transformed into a formidable coalition that challenges Western-led institutions like the IMF and World Bank. Its expansion in 2024–25 has broadened its economic and geopolitical weight. Nearly 40 more nations have expressed interest in joining, which signals growing dissatisfaction with dollar dependency and Western dominance in global finance.

Currently, BRICS+ contributes:

45% of world population (3.64 billion people)

38% of global GDP (₹59.4 lakh crores / $68 trillion)

30% of global oil production

40% of world trade

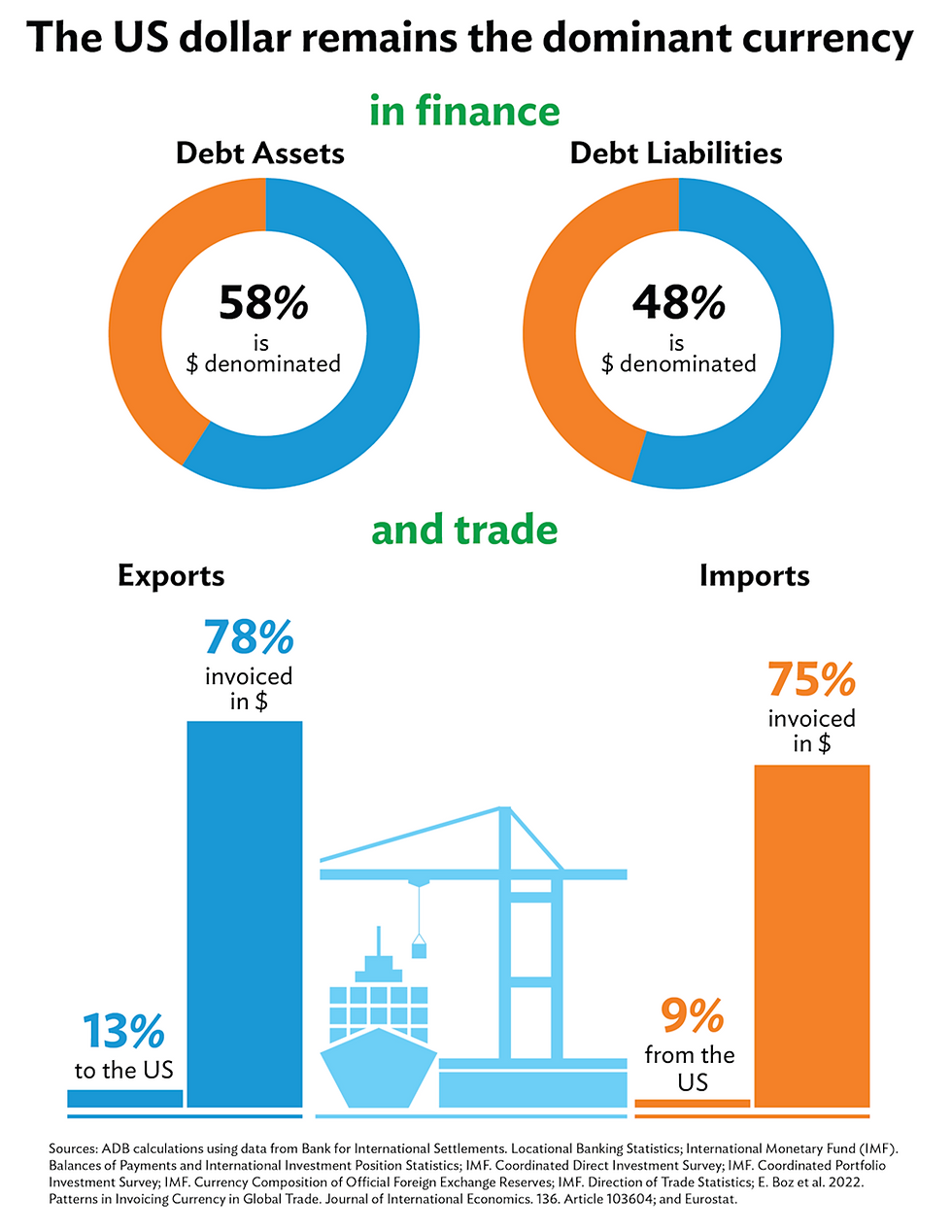

The US Dollar’s Supremacy

For almost a century, the US Dollar has been the world’s primary reserve currency. It dominates international trade and finance:

59% of global foreign exchange reserves are held in USD.

88% of forex transactions involve the USD.

84% of global transactions are conducted in USD.

78% of exports worldwide are invoiced in USD.

This dominance gives the US what economists call the “exorbitant privilege” the ability to print money that the world needs, run large deficits, and impose financial sanctions effectively.

BRICS Currency Initiatives

BRICS is not focused on creating a single currency right away. Instead, it is pursuing multiple strategies:

1. Local Currency Trade

Russia-China trade shifted from 20% to 90% in ruble-yuan settlements within 18 months after sanctions.

China’s renminbi is used in nearly 50% of intra-BRICS trade, though globally it accounts for just 2% of payments.

India has signed local currency trade agreements with 22 countries, including UAE and Malaysia.

This reduces reliance on the dollar while lowering transaction costs.

2. Common BRICS Currency (Long-Term Goal)

The idea of a unified BRICS currency, championed by Brazil’s President Lula, has gained attention. However, major obstacles remain:

Divergent economies (from China’s deflation to Argentina’s hyperinflation)

Different exchange regimes (managed float in India vs. currency pegs in Gulf states)

Political complexity (loss of monetary sovereignty, need for fiscal/monetary unions)

Even the Euro took decades to materialize among more integrated economies. India remains cautious, with leaders clarifying that replacing the dollar is not a policy priority.

3. Digital Payment Systems

A major technological initiative is BRICS Pay—a blockchain-based system allowing direct transactions in local currencies. Features include:

Blockchain foundation for transparency and security

Digital wallets linked to banks

QR code-based payments (similar to India’s UPI and China’s WeChat Pay)

Capacity to process 20,000 messages per second

Alongside, national systems are also being strengthened:

Russia’s SPFS (SWIFT alternative)

China’s CIPS for renminbi trade

India’s UPI, already gaining global adoption

Implications for the Global Economy

For the US

Reduced leverage: De-dollarization weakens America’s ability to impose sanctions.

Higher borrowing costs: Decline in dollar demand could push up US interest rates.

Trade impact: A weaker dollar may help US exports but increase import prices, fueling inflation.

For BRICS Nations

Greater sovereignty: Freedom from US monetary policy shocks.

Lower costs: Direct trade avoids conversion fees.

Sanction resistance: Helps countries like Russia, Iran, and China.

Stability: Insulation from dollar volatility.

Challenges

Despite its ambitions, BRICS faces hurdles:

Liquidity: Non-dollar currencies lack depth for large global trade flows.

Network effects: Dollar dominance reinforces itself—the more it’s used, the more valuable it becomes.

Political rifts: Border disputes (India-China), and Western ties (UAE, Egypt).

Expert views: Studies by Atlantic Council and UC Berkeley suggest the dollar’s dominance will remain intact in the medium term.

Future Outlook

Recent trends show both progress and limitations:

Progress: Growing local currency settlements, development of BRICS Pay, NDB’s expansion.

Limitations: Still a small fraction compared to USD-based trade, lack of unified policy, internal differences.

Digital currencies (CBDCs) and blockchain integration may accelerate de-dollarization, but experts agree this will be a gradual evolution, not a sudden revolution.

The BRICS currency push will not dethrone the US Dollar overnight. Instead, it is building alternatives that gradually chip away at dollar hegemony. For India and other members, the benefits lie in monetary independence, lower transaction costs, and greater bargaining power.

What we are witnessing is the slow emergence of a multipolar monetary system, where the dollar remains dominant but faces credible challengers. In the long term, this could reshape trade, finance, and geopolitics—bringing more balance to the world economy.

Comments