Behavioral Finance: Why Our Brains Can Mess with Our Money?

- Editor

- Aug 20

- 4 min read

by KarNivesh | 20 August, 2025

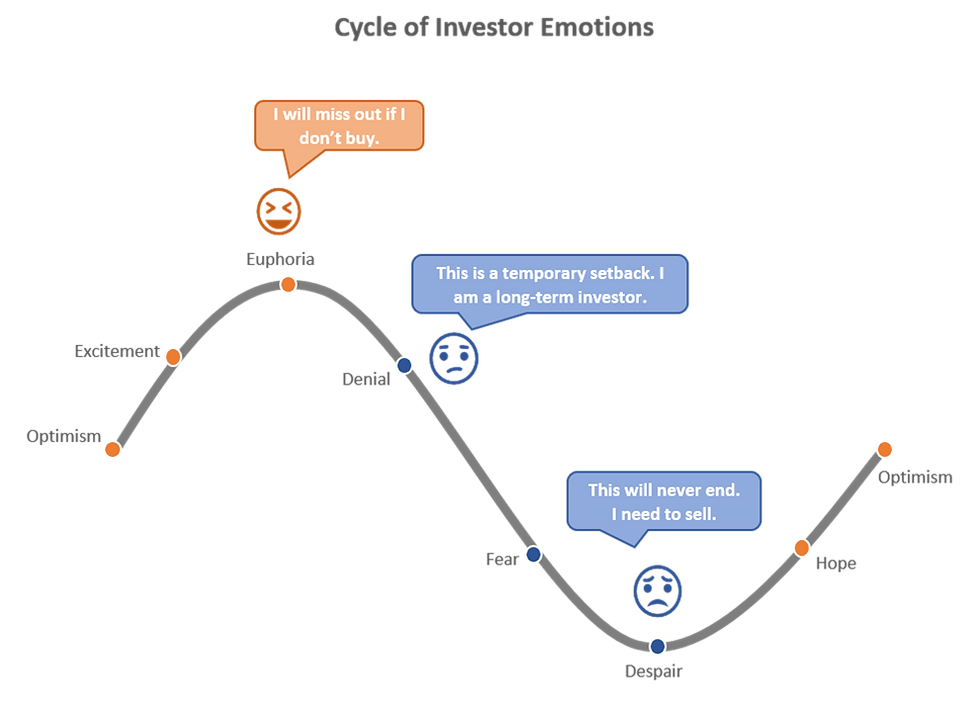

When we think about investing, it’s easy to assume that decisions are based on logic, data, and careful analysis. After all, finance textbooks often describe investors as rational individuals who calculate risks and returns with precision. Yet in reality, most of us are not cold calculators we are emotional human beings. Our decisions are deeply influenced by fear, greed, excitement, and even peer pressure. This is where behavioral finance comes into play.

Behavioral finance is the study of how psychology impacts financial decisions. It explains why we panic-sell during a market crash, chase a “hot stock” tip from a friend, or feel a loss of ₹87,500 far more intensely than the joy of gaining the same amount. By understanding these psychological biases, everyday investors can make smarter choices, avoid costly mistakes, and protect their long-term wealth.

What Exactly Is Behavioral Finance?

Traditional finance assumes that investors are perfectly rational beings who always act in their best economic interest. In this view, people carefully weigh every piece of information before making investment decisions. However, behavioral finance argues that investors are first and foremost human emotional, imperfect, and often influenced by external factors.

Psychologists Daniel Kahneman and Amos Tversky, pioneers of this field, showed how biases and shortcuts in human thinking often lead to irrational outcomes. These biases don’t just affect individual portfolios but can also create larger market patterns like bubbles, crashes, and herd-driven rallies.

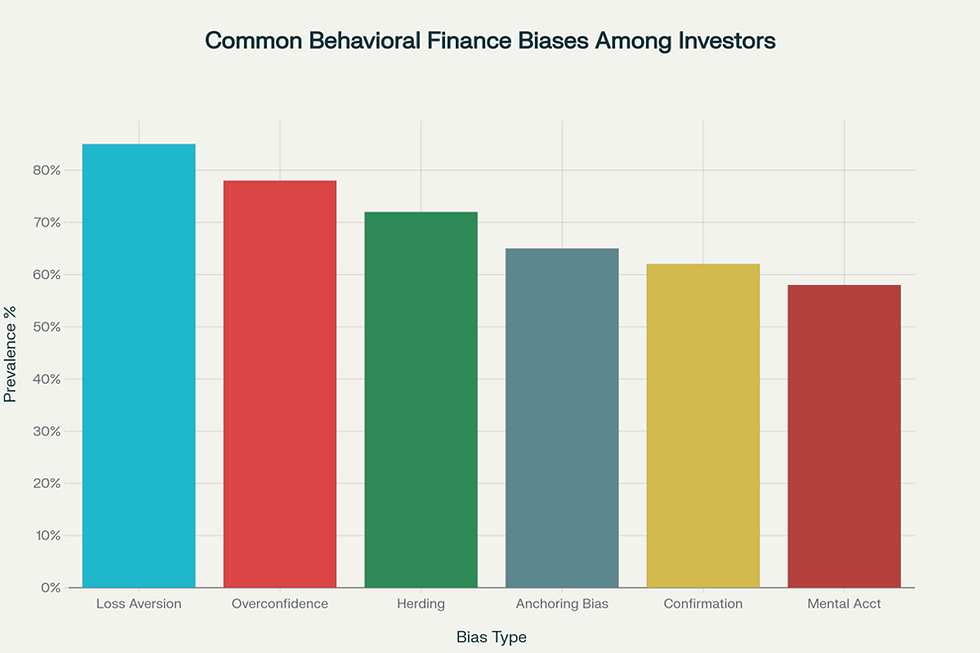

Six Common Biases That Affect Investors

1. Loss Aversion

Research shows that losing ₹87,500 (the equivalent of a $1,000 loss) hurts about twice as much as gaining the same amount brings happiness. Because of this, investors often hold on to losing stocks longer than they should, hoping they’ll bounce back, or avoid investing in equities altogether out of fear.

2. Overconfidence

After a few successful trades, many investors begin to believe they are financial geniuses. This overconfidence leads them to trade excessively, ignore risks, and take bigger bets. Unfortunately, frequent trading increases transaction costs and often results in lower returns over time.

3. Herding Behavior

When everyone around us—friends, family, or financial influencers—starts talking about a booming stock or sector, it feels safer to follow the crowd. This herd mentality has fueled many financial manias, from the global dot-com bubble to India’s IPO rushes. Herding makes investors buy at inflated prices and suffer when the bubble bursts.

4. Anchoring Bias

Anchoring happens when investors rely too heavily on the first piece of information they receive. For example, if a stock’s IPO price is ₹500, many investors continue to judge its worth around that number, even when the market provides new information suggesting a much lower or higher value.

5. Confirmation Bias

Once we form an opinion, we naturally seek information that supports it while ignoring evidence that contradicts it. An investor who believes “small-cap tech is the future” will selectively follow positive news about tech stocks and dismiss warnings, leading to an unbalanced portfolio.

6. Mental Accounting

Instead of treating all money as equal, people mentally divide it into “buckets” like salary, bonuses, or refunds. This often leads to irrational behavior. For example, someone may splurge a ₹87,500 tax refund on luxuries while still paying high-interest credit card debt—something they would never do if they saw all money as part of the same pool.

Real-World Examples of Behavioral Biases

The Dot-com Bubble (1990s–2000) – Driven by hype and herd mentality, many internet-based companies with little or no revenue reached sky-high valuations. When reality set in, about ₹5 trillion in market value was wiped out globally.

Global Financial Crisis (2008) – Panic spread across the world as markets collapsed. Many investors sold off their holdings at rock-bottom prices, missing out on one of the strongest rebounds in financial history.

Indian IPO Rush (2021–24) – Fueled by FOMO (fear of missing out), retail investors piled into flashy IPOs. When many of these stocks lost nearly half their value post-listing, investors continued to hold on to avoid the pain of booking losses.

Key Takeaways

Behavioral finance teaches us that the biggest challenge to wealth creation is not the stock market itself but the human brain. Our instincts—while useful in survival—often push us toward poor financial decisions.

Biases like loss aversion, overconfidence, and herding are predictable but can be managed.

Simple tools such as diversification, automation, and predefined rules help keep emotions in check.

By acknowledging our psychological limits, we can avoid chasing hype, resist panic, and stay committed to long-term financial goals.

Next time you see a sensational headline screaming “Crash Coming!” or “Can’t-Miss Rally!”, pause for a moment. Remember that your brain is wired to react emotionally but you can choose to act rationally. In the long run, mastering these behavioral insights can tilt the odds of financial success in your favor.

Comments