Zepto Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Oct 28

- 2 min read

by KarNivesh | 28 October, 2025

Zepto Limited has quickly become one of India’s most exciting startups, redefining how people shop for daily essentials. Founded during the COVID-19 pandemic by two young Stanford dropouts, Aadit Palicha and Kaivalya Vohra, Zepto started with a bold idea — to deliver groceries in just 10 minutes. What began as a small experiment has now grown into a ₹58,800 crore (around $7 billion) quick-commerce giant, gearing up for its IPO in 2025–2026.

The Journey So Far

Initially launched in 2021 as KiranaKart Technologies, Zepto tried partnering with local stores, but that model didn’t work. The founders then switched to a “dark store” model — small warehouses that keep popular items ready for super-fast delivery. This smart move helped Zepto expand quickly across 40 Indian cities, operating 1,099 mini-warehouses.

From delivering groceries to launching Zepto Café for snacks and drinks, the company has built a loyal customer base that loves convenience.

Growth and Performance

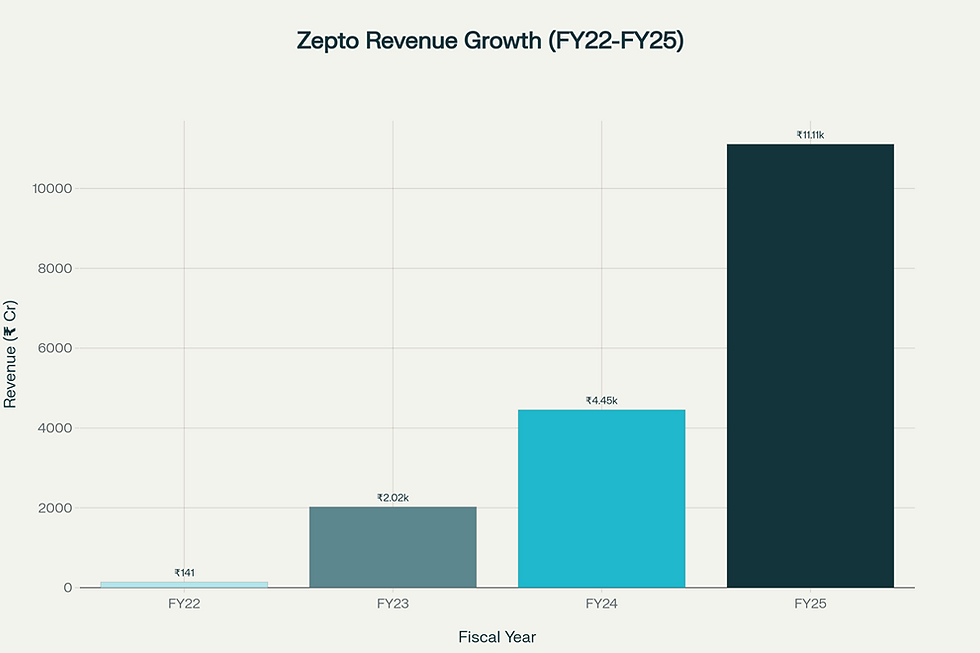

Zepto’s growth story is nothing short of spectacular. Its revenue shot up from ₹141 crore in FY22 to an estimated ₹11,110 crore in FY25, showing massive year-on-year growth. The company has also worked hard to reduce its losses — improving its EBITDA margin from -263% to -27%. Even though it’s still loss-making, Zepto is on a clear path to profitability within the next year.

In October 2025, Zepto raised ₹3,780 crore ($450 million) from global investors like CalPERS and General Catalyst, pushing its valuation to $7 billion. With ₹7,560 crore in cash reserves, Zepto is now financially strong and well-prepared for its upcoming IPO.

Market and Competition

In India’s quick-commerce market, Zepto competes with Blinkit (owned by Zomato) and Swiggy Instamart. Blinkit currently leads with 50% market share, followed by Swiggy (25%) and Zepto (20%). While Zepto’s market share has slightly dropped, it remains the fastest-growing player with impressive delivery speeds — averaging just under 9 minutes per order.

Zepto’s founders still hold an 18% ownership stake, showing their deep commitment to the company’s future. Major investors include Nexus Venture Partners, Y Combinator, and General Catalyst.

Challenges Ahead

Despite its achievements, Zepto faces challenges like rising competition, high cash burn, and regulatory concerns. Issues like food safety violations and gig worker complaints have drawn attention, and the company needs to ensure compliance while maintaining its rapid delivery promise.

Moreover, sustaining profitability in a business that depends heavily on fast delivery and discounts will be a tough balancing act.

The Road Ahead

Zepto’s future looks bright if it can maintain its growth momentum and improve profitability. The company plans to expand to 1,200+ stores by 2026, enter new Tier-2 cities, and strengthen its high-margin businesses like Zepto Café and advertising.

For investors and consumers alike, Zepto’s story is inspiring — a tale of young ambition, bold innovation, and India’s growing appetite for instant convenience. Whether it becomes the “Amazon of quick commerce” or faces growing pains depends on how well it executes its next steps.

Comments