Wipro Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 8

- 2 min read

by KarNivesh | 08 August, 2025

Overview

Wipro Limited, India’s fourth-largest IT services firm, is navigating a complex business landscape in 2025. With a market capitalization of ₹2.5 lakh crores and a share price of ₹239.05, the company reported FY2025 revenues of ₹89,088 crores and a net profit of ₹13,135 crores, achieving a 14.74% net margin. Despite facing marginal revenue contraction for two consecutive years, Wipro remains resilient, backed by strong cash flows, low debt, and a strategic focus on emerging technologies like AI and cloud services.

Founded in 1945, Wipro has evolved into a global IT powerhouse with over 233,000 employees across 66 countries. Its services span digital transformation, consulting, engineering, and business process outsourcing. In 2025, Wipro realigned its business into four key verticals Technology Services, Consulting, Engineering Edge, and Business Process Services to improve client focus. Notable partnerships include a multi-million-dollar deal with Nokia and a collaboration with Intel Foundry aimed at AI chip innovation.

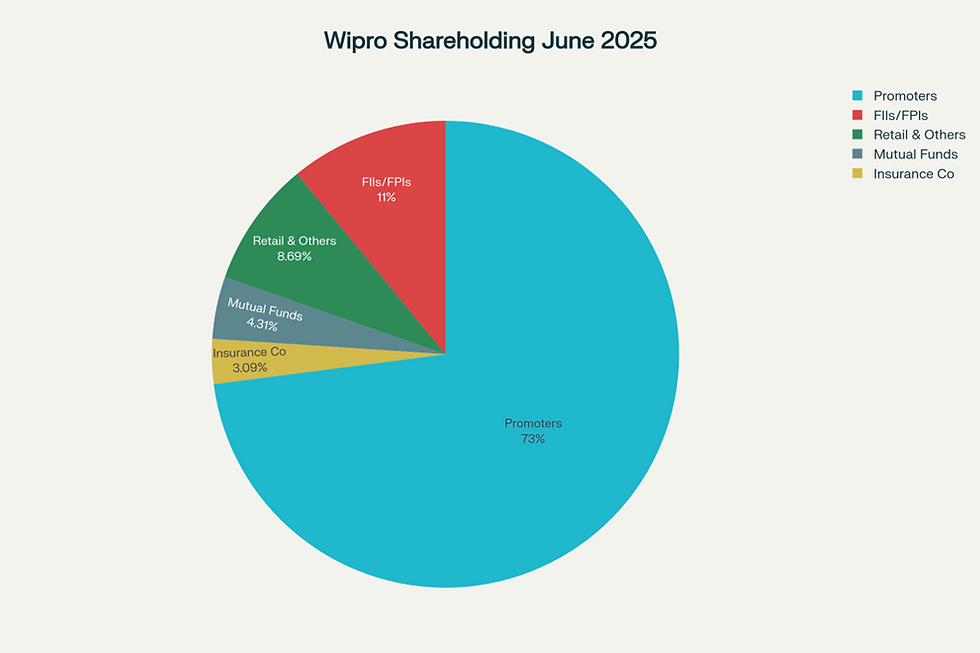

Financially, Wipro saw revenue growth in FY2021-23, followed by slight declines in FY2024 and FY2025. Its earnings per share (EPS) rose to ₹12.56 in FY2025. Key valuation metrics include a P/E ratio of 18.66, below the industry average, and a 4.6% dividend yield. The company has a debt-to-equity ratio of just 0.23, strong liquidity (current ratio of 2.83), and ₹12,197 crores in cash reserves. Promoters hold 72.66% of shares with no pledges, indicating strong promoter confidence, while foreign and domestic institutions show moderate interest.

Compared to peers like TCS, Infosys, and HCL, Wipro lags in revenue growth and return on equity, but trades at an attractive valuation. It also provides a higher dividend yield and maintains a diverse global footprint. However, Wipro has seen negative stock performance recently, with a 23.8% decline over six months, although its five-year return stands at over 74%.

Wipro’s business model includes services in cloud, cybersecurity, AI, consulting, and engineering. Around 62% of revenue is derived from the Americas, followed by Europe (27%), making it vulnerable to U.S. economic and policy shifts. Strengths include its global presence, diverse offerings, robust ESG practices, and recent large deal wins. However, challenges persist such as high attrition, overreliance on the U.S., and a slower pace of innovation compared to peers.

The company is well-positioned to benefit from rising demand for digital transformation, AI, 5G, and cybersecurity. Yet, it faces threats from intense competition, regulatory changes, macroeconomic pressures, and currency fluctuations. Its latest CEO transition in 2024 adds uncertainty to strategic continuity. In conclusion, Wipro offers stable long-term potential through strategic investments in AI and cloud, despite short-term headwinds. It appeals to value investors seeking income and exposure to the IT sector but requires close monitoring due to revenue stagnation and competitive challenges.

Comments