Weekly Market Report 04 Aug 2025 to 08 Aug 2025 | Scrolls

- Editor

- Aug 9

- 3 min read

by KarNivesh | 09 August, 2025

Indian equities recorded their sixth straight week of losses, the longest losing streak since April 2020, as US tariff concerns, mixed earnings, and persistent FII selling weighed on sentiment. However, strong buying from domestic institutional investors (DIIs) cushioned the decline and kept volatility contained.

Market Performance

NIFTY 50 fell 0.95% to 24,363.30 and SENSEX slipped 0.95% to 79,857.79. Bank Nifty showed resilience, down 0.67%, while midcaps and smallcaps underperformed. The NIFTY Next 50 dropped 1.24%, indicating broad-based selling.

Globally, US markets gained in July on robust earnings, but tariff risks persisted. European equities saw modest gains despite trade headwinds, and China rose 8.53% but faced weak export demand.

Macroeconomics & Policy

The RBI kept the repo rate at 5.50% and maintained a neutral stance, with FY26 inflation forecast cut to 3.1% and GDP growth at 6.5%. The Governor noted minimal disruption expected from US tariffs.

US Q2 GDP grew 3.0%, though payroll gains slowed sharply. Inflation averaged 2.6% in H1, expected to rise in H2, boosting September rate cut odds to 95%. Europe posted slight GDP growth and steady inflation.

Corporate Earnings & Sector Highlights

Q1 FY26 earnings were mixed: revenue up 7.02% YoY, profit up 7.97%, below expectations.

SBI: Net profit +12% to ₹19,160 crore, strong operational efficiency.

Tata Motors: Profit –30% due to demand and cost pressures.

LIC: Profit +5%, steady premiums.

BSE Ltd: Profit +103% on higher market activity.

Sector-wise:

Media & Entertainment led with 108% profit growth.

Pharma outlook strong, projected to reach ₹10.5 to ₹11.4 trillion by 2030.

Banking stable with governance reforms from Aug 1.

IT faced budget constraints but retains long-term strength.

IPO Activity

Active primary market with JSW Cement and Sawaliya Food Products IPOs open. SME IPOs continued momentum, with 71% listing gains in 2025.

Currency & Bonds

The rupee weakened to 87.56/USD, down 4.3% YoY on FII outflows, strong USD, and trade deficit worries. The 10-year G-sec yield eased to 6.38%. Corporate bond issuances remain strong, targeting ₹11 trillion in FY26.

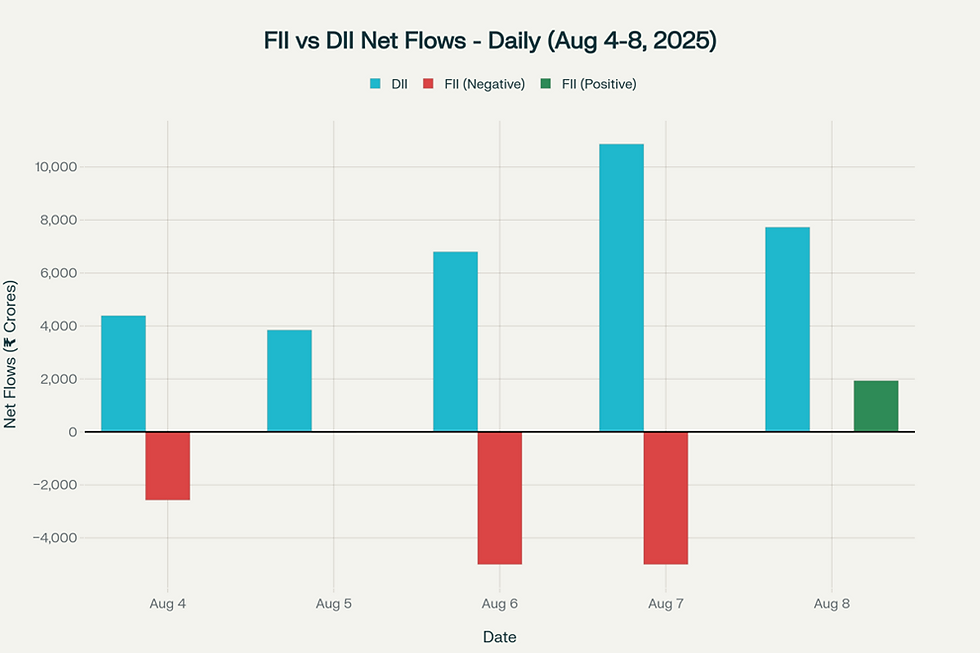

Institutional Flows & Sentiment

DIIs bought ₹33,609 crore while FIIs sold ₹10,652 crore. Domestic ownership (17.62%) surpassed foreign (17.22%) for the first time. India VIX rose slightly to 12.03, indicating low volatility. India VIX is a volatility index that measures market participants’ expectations of near-term volatility in the Nifty 50 index.

Global Events & Commodities

US tariffs reached an average 18.2% highest since 1934 impacting trade talks, including with India. Oil stayed range-bound, gold/silver rose, and industrial commodities slipped. Geopolitical tensions persisted in Ukraine and the Middle East.

Key data ahead

US CPI, PPI, and jobless claims; India’s industrial production and trade balance. CPI (Consumer Price Index) is an economic indicator that tracks changes in the average prices of goods and services consumed by households, reflecting retail inflation. PPI (Producer Price Index) is a measure of the average change in prices that domestic producers receive for their goods and services, indicating wholesale inflation trends.

Focus sectors include pharma (strong growth drivers), banking (stability from reforms), and IT (structural advantage despite short-term headwinds). Current correction may offer entry points into quality stocks with robust fundamentals.

Comments