Vedanta Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 12

- 3 min read

by KarNivesh | 12 August, 2025

Vedanta Limited is emerging as one of India’s most compelling investment stories in the metals and mining sector. With strong fundamentals, improved financial performance, and a major restructuring on the horizon, the company offers both growth potential and steady income for investors.

The Big Picture – Why Vedanta Stands Out

Vedanta has been in the natural resources business since 1965. It’s not just an Indian company – it has operations in countries like South Africa, Namibia, and Liberia too. It is part of the UK-based Vedanta Resources Limited group.

The company works in different areas, so it doesn’t depend on just one product. Its main businesses are:

Aluminum – 35% of revenue

Zinc-Lead-Silver – 25% of revenue

Oil & Gas – 20% of revenue

Iron Ore – 10% of revenue

Copper & Steel – 10% of revenue

This mix helps Vedanta manage ups and downs in commodity prices.

The Demerger Plan – Splitting to Grow

Vedanta plans to split into five independent listed entities—Aluminum, Oil & Gas, Power, Iron & Steel, and Base Metals—by September 2025.Expected Benefits:

Sharper operational focus.

Better capital allocation.

Access to specialized funding.

Potential market cap boost from ₹1.80 lakh crore to ₹2.73 lakh crore.

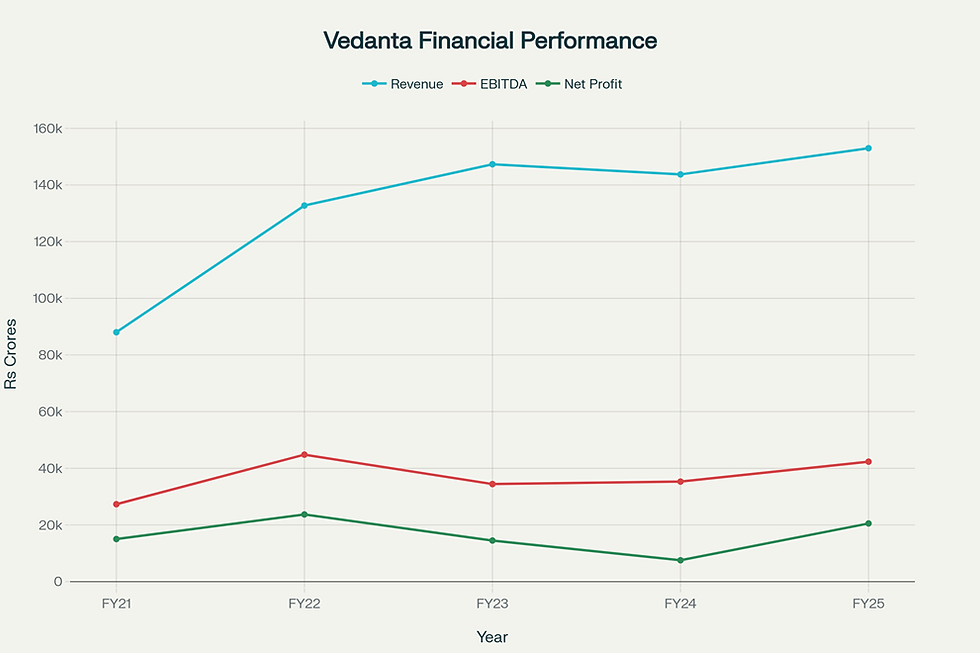

Financial Performance

Vedanta has shown a sharp recovery in the last five years:

Revenue grew 74% – from ₹88,021 crores in FY21 to ₹1,52,968 crores in FY25.

EBITDA (a measure of operating profit) rose 55% to ₹42,343 crores.

Net Profit jumped 37% to ₹20,535 crores.

In Q1 FY25 alone:

Revenue: ₹35,239 crores (+6% YoY)

EBITDA: ₹10,275 crores (+47% YoY)

Net Profit: ₹5,095 crores (+54% YoY)

It also has one of the highest EBITDA margins in the industry at 34%.

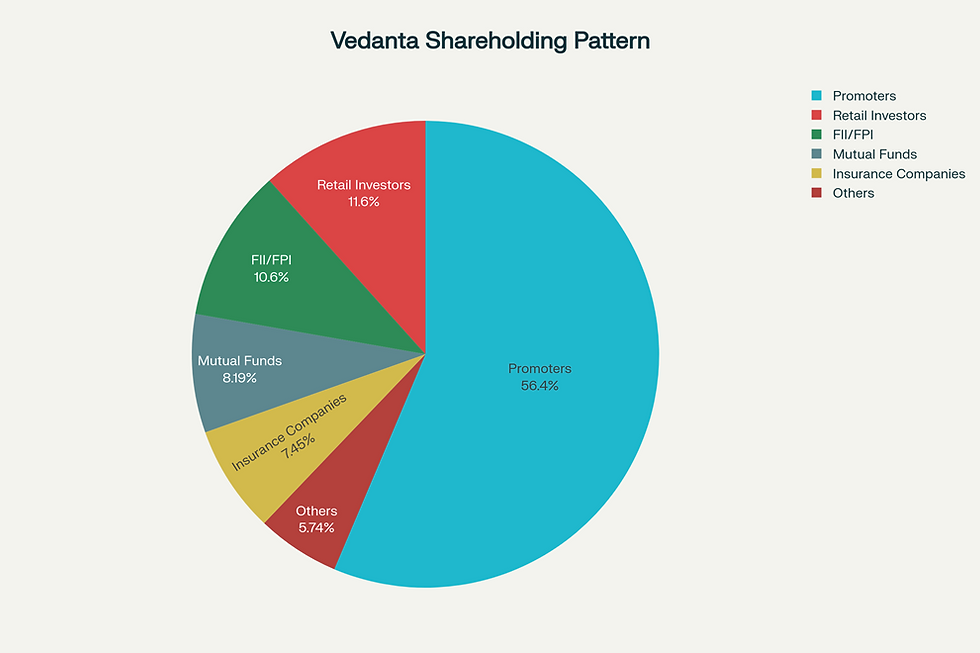

Shareholder Structure – Who Owns Vedanta?

Promoters own 56.38% (down from 61.95% last year)

Foreign investors (FII/FPI) own 10.60% – showing rising global interest

Mutual funds hold 8.19%

Retail investors have 11.64%

Another positive – Vedanta has zero pledged shares now, compared to almost 100% earlier.

Business Segment Highlights

Aluminum – The Growth Engine

Largest aluminum producer in India (60% market share)

Expanding capacity with ₹12,450 crore investment

Record production in Q1 FY25

Zinc – The Cash Cow

Second-largest zinc reserves globally (via Hindustan Zinc)

Major expansions planned, including a ₹12,000 crore zinc metal complex in Rajasthan

Oil & Gas – The Stable Cash Flow

Operated mainly through Cairn India

Aiming to increase oil output five-fold with₹41,500 crore investment

Stock Performance & Valuation

Current share price: ₹431–₹436, mid-range of its 52-week high of ₹527 and low of ₹363.

PE Ratio: 11.2–11.6x (lower than peers – meaning potentially undervalued)

Dividend Yield: 10.1% – among the highest in large-cap stocks

In the last five years, the stock is up 242%, showing long-term wealth creation potential.

Risks

No company is risk-free. For Vedanta, the main challenges are:

Commodity price swings – profits depend on prices of metals and oil

Regulatory rules – mining has strict environmental regulations

Debt levels – though improving, debt remains high

ESG concerns – environmental and sustainability ratings need improvement

Vedanta Limited is not just a mining company – it’s a diversified natural resources giant. With strong profits, a high dividend yield, and a big demerger on the horizon, it offers both growth and income opportunities. But since it’s linked to commodity prices, it’s best suited for investors who understand that markets can have ups and downs in the short term.

For those willing to ride out the volatility, Vedanta could be a rewarding part of a well-diversified portfolio.

Comments