The Indian Hotels Company Ltd (IHCL):Comprehensive Stock Analysis Report | Scrolls

- Editor

- Sep 9

- 3 min read

by KarNivesh | 09 September, 2025

The Indian Hotels Company Ltd (IHCL), part of the Tata Group and owner of the iconic Taj brand, has emerged as one of the strongest players in India’s booming hospitality sector. Over the last few years, IHCL has combined operational excellence, brand power, and strategic diversification to deliver impressive growth. For investors, the company’s performance and future plans present a compelling long-term opportunity.

Strong Stock Performance

IHCL has rewarded its investors with remarkable returns. From January 2023 to September 2025, its stock price surged from ₹317 to ₹775, representing a 144% rise in just 2.5 years. This growth reflects the company’s strong execution, financial discipline, and its ability to capture opportunities in the travel and tourism sector.

Diverse Business Model

IHCL operates more than 350 hotels across 12 countries, making it India’s largest hospitality company. Its portfolio includes Taj, Vivanta, SeleQtions, Gateway, and Ginger hotels, catering to luxury, upscale, and midscale markets.

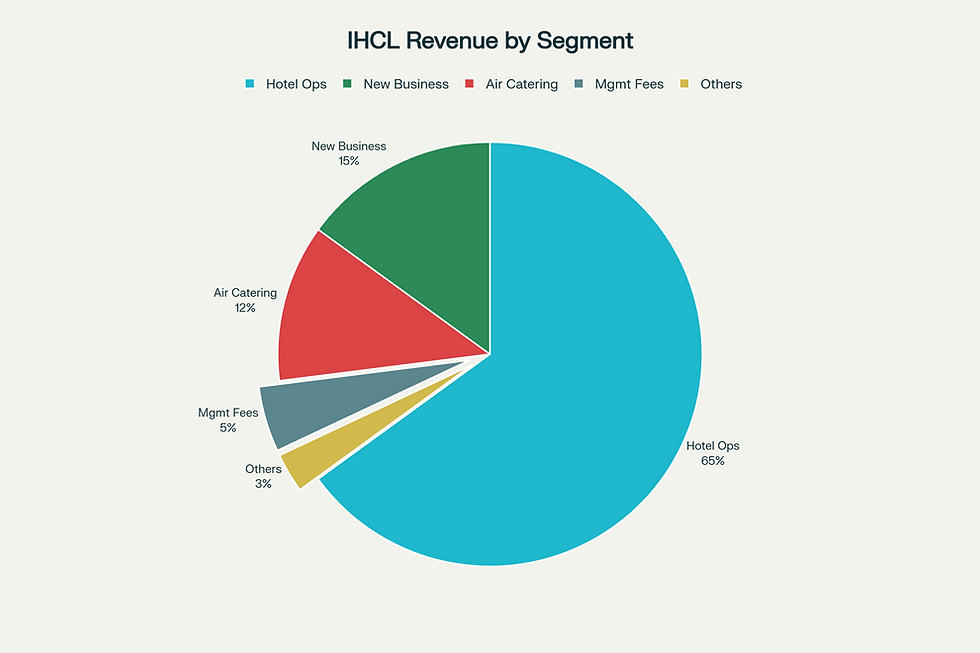

A key strength of IHCL lies in its diversified revenue streams:

Hotel operations contribute 65% of revenue.

TajSATS air catering accounts for 12%.

New businesses like Ginger hotels, Qmin food delivery, and homestays add 15%.

Management fees form another 5%.

This mix ensures stability by reducing dependence on the cyclical hotel business while building high-margin verticals.

Financial Performance

IHCL has reported excellent financial growth. Its consolidated revenue grew from ₹5,810 crores in FY23 to ₹8,335 crores in FY25, marking a 40% CAGR. Net profit nearly doubled during the same period, rising from ₹1,053 crores to ₹2,038 crores.

Other financial highlights include:

EBITDA margins improved to 33.2%.

EPS grew from ₹7.06 to ₹13.40.

Debt-to-equity ratio reduced from 0.45 to 0.28, reflecting stronger balance sheet health.

With a market cap of over ₹1.1 lakh crore, IHCL clearly enjoys a leadership premium in India’s hospitality industry.

Strategic Growth Plans

IHCL is already ahead of its “Ahvaan 2025” targets and has now launched its “Accelerate 2030” vision. The plan aims to:

Expand to 700+ hotels by 2030 (from 350 currently).

Increase operational hotels from 247 to 500.

Expand room inventory from 42,500 to 70,000.

Double revenue to ₹15,000 crores by 2030.

This growth will be supported by a ₹5,000–₹6,000 crore investment plan, focused on Tier 2 and Tier 3 cities, boutique hotels, and international expansion.

Risks to Watch

Like all hospitality businesses, IHCL faces challenges such as:

Cybersecurity risks (a recent malware incident highlighted vulnerabilities).

Labor shortages and wage inflation.

Seasonal and economic volatility.

Competition from global hotel chains like Marriott.

Despite these risks, IHCL’s strong financials, brand leadership, and diversification reduce long-term concerns.

Conclusion

IHCL is more than just a hotel chain—it is shaping into India’s most valuable hospitality ecosystem. Backed by the trust of the Tata Group and strong investor confidence, IHCL offers long-term growth potential. For investors willing to look beyond short-term volatility, the stock remains a solid play on India’s rising affluence and booming travel sector.

Comments