Sun Pharmaceutical Industries Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 11

- 2 min read

by KarNivesh | 11 August, 2025

Overview

Sun Pharmaceutical Industries Limited, India’s largest pharmaceutical company by market capitalization (₹3.85 lakh crores as of Aug 2025), has evolved from a domestic generics maker to a global healthcare leader operating in 100+ countries. Founded in 1983 and headquartered in Mumbai, it offers generics, branded generics, specialty medicines, OTC products, and APIs through 40+ manufacturing facilities and a workforce of over 38,000. Holding an 8.3% share in India’s pharmaceutical market, Sun Pharma leads in prescriptions across 13 therapeutic areas.

Financial Performance: In FY25, consolidated gross sales rose 9% to ₹52,041 crores, with net profit growing 13.7% to ₹10,929 crores outpacing revenue growth due to operational efficiency. EBITDA grew 17.3% to ₹15,272 crores with margins improving to 29%. The India formulations business saw 13.7% growth to ₹16,923 crores. Q1 FY26 sales were ₹13,786 crores (up 10% YoY), but reported net profit fell 20% due to exceptional US restructuring costs; adjusted net profit still rose 5.7%.

Valuation & Ratios: The stock trades at a P/E of 36.7x and P/B of 5.25x, reflecting premium positioning. EPS (TTM) is ₹43.23, ROE 15.13%, and ROCE 20.2%. With negligible debt (D/E 0.03), Sun Pharma maintains financial flexibility. FY25 dividend totaled ₹16 per share, up from ₹13.50 in FY24.

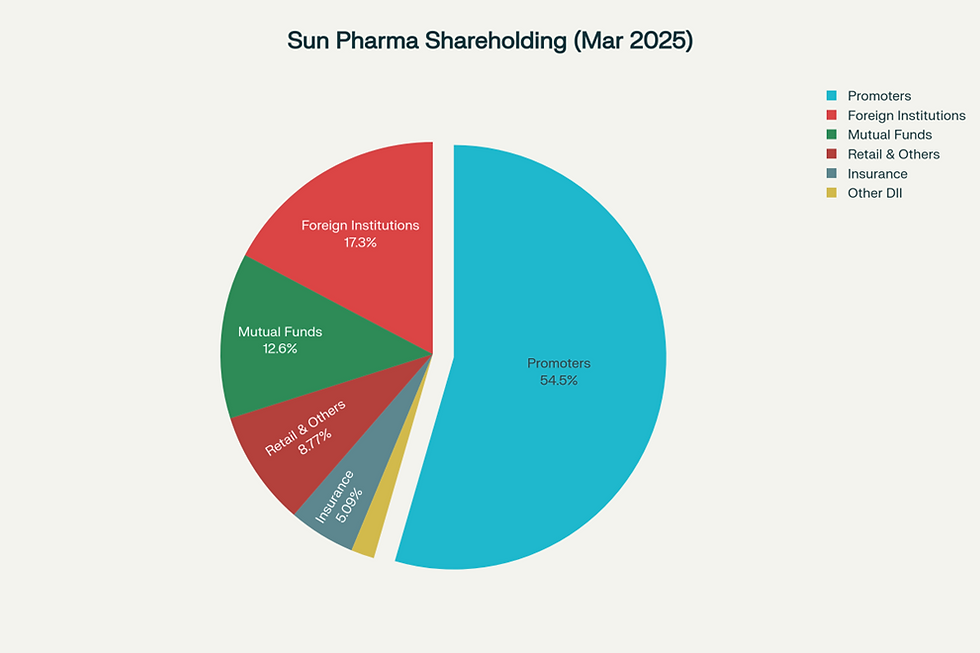

Ownership Structure: Promoters hold 54.48%, FIIs 17.26%, Mutual Funds 12.63%, and retail investors 8.77%. Minimal promoter share pledging (4.04%) supports governance stability.

Business Segments & Growth Drivers: Key segments include India Formulations (32% of revenue), US Formulations (31%), Global Specialty (19.7%), and Emerging Markets (₹9,500 crores in sales). Specialty drug sales grew 17.1% to ₹10,400 crores, led by dermatology, oncology, and ophthalmology. R&D investment was ₹3.2 billion in Q1 FY26, targeting high-margin therapeutic areas.

Strategic Moves: Acquisitions like Checkpoint Therapeutics ₹2,964.25 crores brought in immuno-oncology drug Unloxcyt, while partnerships with Philogen enhance cancer treatment capabilities. The company is expanding in emerging markets to diversify revenue streams.

Risks & Challenges: Regulatory issues persist, especially at the Halol plant under US FDA import alert. Generic pricing pressure in the US and competition in specialty drugs from Pfizer and Eli Lilly could affect margins. Premium valuation heightens sensitivity to earnings or regulatory setbacks. Currency fluctuations and multi-jurisdiction compliance are ongoing challenges.

Sun Pharma’s strong domestic leadership, global specialty drug focus, and robust financials support its premium valuation. While regulatory and market risks remain, its innovation pipeline, strategic acquisitions, and diversified revenue base position it for sustained long-term growth.

Comments