SRF Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 27

- 4 min read

by KarNivesh | 27 August, 2025

When we think about companies that quietly power many parts of our daily lives, SRF Limited is a name worth knowing. From chemicals used in everyday products to films and fabrics that touch industries worldwide, SRF has grown into one of India’s leading diversified companies. Let’s take a friendly walk through what this company does, how it’s performing, and what it means for people interested in its stock.

Company Overview

SRF Limited began back in 1970 as Shri Ram Fibres, originally focused on tyre cords. Over the years, it transformed into a diversified chemical powerhouse with operations spread across India and abroad. Today, the company has four main business segments:

Chemicals Business – Its growth engine, including specialty chemicals for agro and pharma industries and refrigerant gases.

Performance Films & Foils – Packaging films used globally.

Technical Textiles – Fabrics for tyres and industrial use, though this part has been struggling.

Other Businesses – Smaller segments that support the core.

What makes SRF special is its global footprint—plants in India, Thailand, South Africa, and Hungary—and customers in over 90 countries.

Financial Health in Simple Terms

Looking at the last five years, SRF’s journey has had ups and downs. Revenue climbed from around ₹8,300 crore in FY21 to nearly ₹14,700 crore in FY25. That’s solid growth, though not always smooth—one year saw a dip before bouncing back.

Profits, however, have been under pressure. Net profit margins shrank from about 15% in FY22 to under 9% in FY25. Why? Rising costs, new competition (especially from China), and heavy investments into expansion. Still, even with thinner margins, SRF made a strong ₹1,251 crore in profit in FY25.

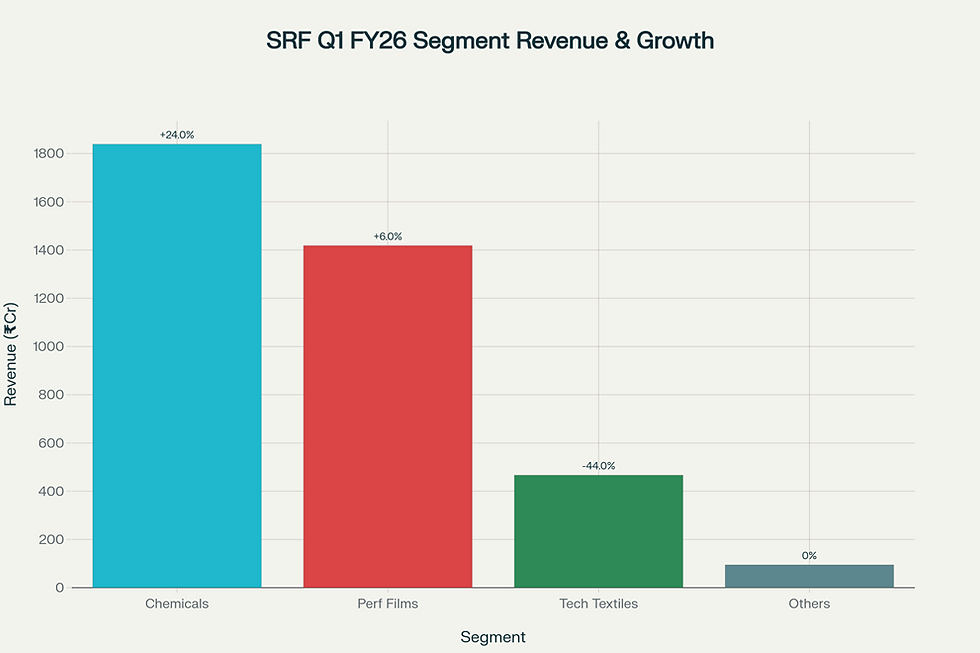

The most recent quarter (Q1 FY26) showed good news: revenue grew 10%, and profits jumped a huge 71% compared to last year. This surprised analysts, mainly thanks to strong performance in the chemicals segment.

Strengths and Weaknesses

Like any business, SRF has both bright spots and challenges.

Strengths:

Market leader in key segments like refrigerants.

Diversified businesses, reducing dependency on one product.

Strong R&D, with hundreds of patents filed.

Solid global presence with opportunities to expand.

Challenges:

Margins are shrinking due to high costs and competition.

Technical Textiles (its original business) is facing structural decline.

Stock valuation is expensive, meaning investors are already paying a high price for its growth story.

Chemicals is capital-intensive, requiring big investments before profits catch up.

What About the Stock?

SRF’s stock has been rewarding for long-term investors, giving returns of over 23% in the past two years. It even touched a record high of ₹3,325 in July 2025 before cooling off to around ₹2,850.

Analysts say the stock still has potential, with price targets ranging between ₹2,080 and ₹3,717. That wide range shows there’s some uncertainty, especially given global economic headwinds.

But here’s the catch: the stock trades at a very high valuation. A price-to-earnings (P/E) ratio of about 60x is far above industry averages. In simple terms, the market is already assuming strong future growth, leaving less “safety cushion” if things don’t go as planned.

Future Plans and Growth

SRF isn’t sitting still. It has announced massive investments worth over ₹1,500 crore in new projects, including a state-of-the-art refrigeration plant and packaging film facilities. The company is also betting big on next-generation chemicals that are more sustainable and environmentally friendly.

On the innovation side, SRF continues to invest heavily in R&D, giving it an edge in specialty chemicals and advanced materials. Partnerships with global players like Chemours further strengthen its position.

The management has ambitious goals—aiming to triple revenue in just three years. If executed well, this could keep SRF on its strong growth path.

Risks to Keep in Mind

For everyday investors, it’s important to remember the risks too:

The chemicals industry is cyclical and affected by global ups and downs.

Heavy dependence on global demand means a recession abroad can hurt.

Premium valuations mean the stock could see big swings with market sentiment.

Environmental and regulatory pressures require continuous adaptation.

Should Investors Consider It?

Here’s a simple way to think about it:

For long-term investors: SRF is a strong company with leadership in niche markets. Its growth plans, global presence, and innovation capabilities make it attractive.

For cautious or value-focused investors: The stock looks expensive right now. Waiting for dips or market corrections could offer better entry points.

For income-focused investors: SRF pays a small dividend (just 0.27%), so it’s not the best choice if you’re looking for regular income.

In short, SRF is a high-quality company, but its stock is priced at a premium. The business story is solid, but patience and timing matter.

Final Thoughts

SRF Limited is like a well-built car driving on a good road—but the fuel (profits) has been getting costlier, and the ticket (stock price) isn’t cheap. For those willing to hold through the bumps, the long journey could still be rewarding. But for anyone jumping in now, keeping an eye on valuations and risks is essential.

As with all investments, balance is key. SRF has shown resilience, ambition, and innovation—and while challenges exist, its future remains promising.

Comments