Solar Industries India Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 26

- 4 min read

by KarNivesh | 26 August, 2025

When we think of companies that quietly transform themselves into market leaders, Solar Industries India Limited is a name that stands out. From starting as a traditional explosives manufacturer in 1995, the company has now become a global force in industrial explosives and is making serious moves in defense technology. Its story is one of rapid growth, impressive achievements, and also a reminder that big success often comes with big risks.

Company Overview

Solar Industries is based in Nagpur and runs the world’s largest explosives manufacturing facility at a single location. Imagine a factory capable of producing 300,000 metric tons of explosives each year—that’s the scale we’re talking about.

The business mainly operates in three areas:

Industrial Explosives (70-75%) – These are used in mining, construction, and infrastructure projects.

Defense & Aerospace (17-20%) – This includes missile propellants, warheads, drones, and even anti-drone systems.

International Operations (40% of revenue) – The company has a presence in 9 countries and sells to over 90 nations.

What this means in simple terms is that Solar Industries is not just an “India-focused” company. Its earnings come from many parts of the world, making it less dependent on the ups and downs of one market.

Financial Growth that Turns Heads

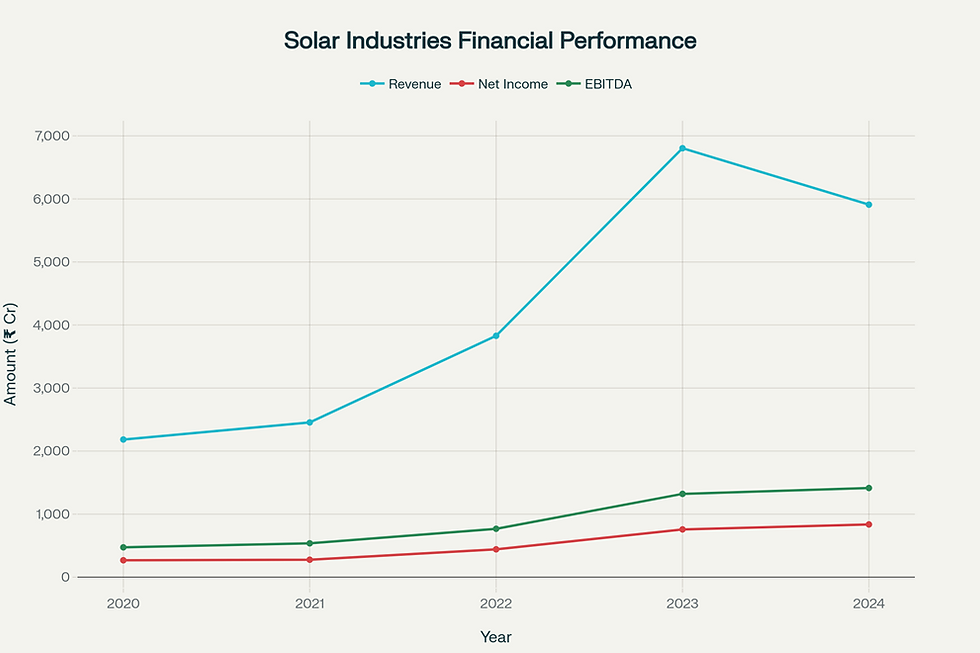

Numbers often tell the best stories, and Solar Industries has some truly impressive ones. In just four years (2020–2024), its revenue went from ₹2,183 crores to ₹5,909 crores. Profits grew even faster, from ₹267 crores to ₹836 crores.

In terms of return ratios—how efficiently a company uses money—it shines brightly:

Return on Equity (ROE): 25.29%

EBITDA Margin: 23.92%

Return on Capital Employed (ROCE): 34.54%

For a layperson, these percentages basically mean the company is squeezing a lot of value out of every rupee invested.

On the balance sheet side, Solar has reduced its debt (loan burden) over time and is generating strong free cash flow. This shows it’s financially healthy and can fund its growth without relying too heavily on borrowing.

Who Owns the Company?

A big plus is that promoters (the founding family) own over 73% of the company. This shows strong commitment and reduces the chance of an outside takeover. Apart from them, mutual funds, foreign investors, and retail investors also hold stakes.

The Stock Market Journey

Solar Industries has been a darling of the stock market. Over the past five years, it has given mind-blowing returns of more than 1,200%. In 2025 alone, the stock is already up by 44%.

However, this growth comes at a cost. The stock trades at a price-to-earnings (P/E) ratio of 101.88. For context, most strong companies trade between 20 and 40. This means the stock is extremely “expensive” in valuation terms.

Simply put, while the company is excellent, the share price may already reflect most of its future growth, leaving little margin of safety for new investors.

The Shift Towards Defense

Perhaps the most exciting part of Solar’s journey is its transformation into a defense technology player. From supplying explosives to making rocket propellants, UAVs (drones), and anti-drone systems, the company is at the forefront of India’s defense modernization.

The defense business, which was just 6% of its revenue in 2023, has already jumped to 17% in 2025 and is expected to hit 30–35% in the coming years. With a defense order book of ₹15,000 crores, the growth potential here is massive.

The Opportunities Ahead

Here are some reasons why Solar could keep growing strongly:

India’s infrastructure push will need more explosives for mining and construction.

Its global reach ensures it earns from multiple markets.

The defense sector boom is only beginning, and Solar is already well-placed.

Continuous research and development keeps it ahead of competition.

The Risks to Keep in Mind

No investment is without risks, and Solar has its share:

High Valuation: The stock price is already very high compared to its earnings.

Cyclical Demand: Mining and infrastructure sectors depend on economic conditions and even monsoon seasons.

Execution Challenges in Defense: Defense projects take years and come with high risks of delays and failures.

Regulation: Explosives and defense are heavily regulated, adding another layer of complexity.

What Should Investors Do?

Here’s the takeaway in simple terms:

If you are a growth investor who believes in India’s defense and infrastructure story, Solar is worth considering for the long run.

If you are a value investor, the current price may feel too expensive. Waiting for corrections could be wise.

If you are an income investor, Solar may not be for you since its dividend yield is just 0.07%. The company reinvests profits instead of paying them out.

Final Thoughts

Solar Industries India Limited is a shining example of how an Indian company can grow from being a traditional business into a global player in cutting-edge defense technology. Its fundamentals are strong, and its future looks promising.

But investors should not get carried away by past returns alone. The stock’s high valuation means new buyers need to be cautious and patient. For those with a high-risk appetite and a long-term outlook, Solar could be a star performer. For others, it may be better to admire this success story from the sidelines until the price becomes more reasonable.

Comments