Nestle India Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 20

- 2 min read

by KarNivesh | 20 August, 2025

Overview

Nestlé India Limited, the Indian subsidiary of Swiss multinational Nestlé S.A., is a leading player in the FMCG sector with a strong brand portfolio and exceptional profitability. Operating since 1959, the company has grown remarkably, increasing its turnover 2.5 times in the last decade from ₹8,100 crores in 2015 to ₹20,260 crores in FY2025. Despite challenges like commodity inflation and leadership transition, Nestlé remains a premium-quality stock with unmatched financial strength.

Leadership and Strategy

In August 2025, Manish Tiwary, formerly of Amazon India and Unilever, will succeed Suresh Narayanan as Chairman and MD. Tiwary is expected to strengthen digital transformation and e-commerce, areas of increasing importance in Nestlé’s strategy.

The company has diversified its business model since the Maggi crisis in 2015. Today, revenue is spread across four segments Milk Products & Nutrition (40.8%), Prepared Dishes & Cooking Aids (30.5%), Confectionery, and Beverages. This diversification has reduced dependency on a single product and strengthened revenue stability. Financial Performance

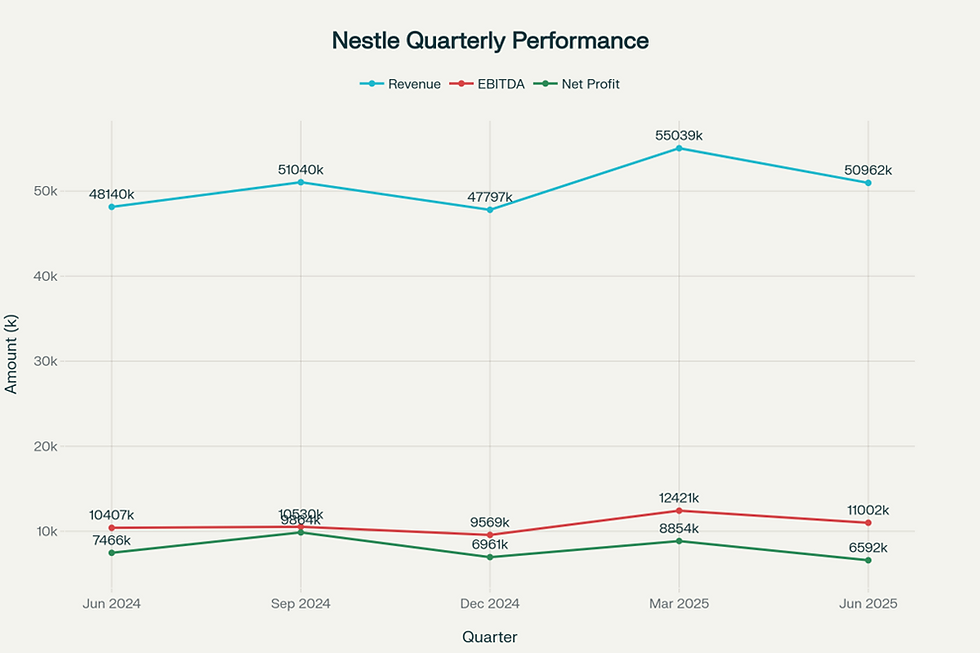

Nestlé has delivered a 10-year revenue CAGR of 10.3%, outpacing peers. However, FY2025 revenue declined 17.45% to ₹20,260 crores from ₹24,542 crores in FY2024, mainly due to cost pressures and aggressive pricing amid input inflation. Net profit margins remain strong at 15.87%, with EBITDA margins consistently above 20%.

The company’s returns are industry-leading ROE at 83% and ROCE at 95.66% versus industry averages of 25% and 20%. Q1 FY2026 saw 5.9% revenue growth but a net profit decline of 11.7% due to margin pressure.

Market Position and Segments

Nestlé India dominates several categories: 60% share in instant noodles (Maggi), 96% in infant cereals, and leadership in coffee premixes. Its distribution spans 5.2 million retail outlets, reaching nearly two-thirds of Indian households. India is now the largest global market for Maggi and the second-largest for KitKat.

Innovation has accelerated, with over 150 new launches since 2015 contributing 7% to sales. Rural expansion is another focus, with Nestlé covering over 2 lakh villages. Valuation and Peer Comparison

Nestlé trades at a P/E ratio of 75.45x much higher than the FMCG sector average of 41.9x. The Price-to-Book ratio is also steep at 55.80x, reflecting investor confidence in its brands and efficiency. Compared to peers, Nestlé shows stronger returns but comes at a premium valuation. For instance, Hindustan Unilever trades at 59.03x P/E with 27.85% ROCE, while ITC is at 25.60x P/E with 36.79% ROCE. Risks

Key risks include 60–70% inflation in raw material costs (coffee, cocoa, edible oils), stiff competition from regional FMCG players, regulatory challenges (as seen in the Maggi ban of 2015), and the risk of overvaluation given its high P/E ratio. Nestlé India stands as a resilient FMCG giant with unmatched profitability, dominant market share, and strong innovation capabilities. While commodity inflation and premium valuations are near-term concerns, its diversified portfolio, rural expansion, and digital strategy position it strongly for long-term sustainable growth.

Comments