Lupin Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Sep 29

- 3 min read

by KarNivesh | 29 September, 2025

Overview of Lupin Limited Stock Analysis

Lupin Limited, a Mumbai-based transnational pharmaceutical company founded in 1968, has staged a remarkable turnaround in recent years. In FY25, the company reported a 12.9% year-on-year increase in revenue to ₹22,192 crore, while net profit surged to ₹3,282 crore from losses in FY22. This recovery has elevated return on equity (ROE) to 19%, reflecting strong profitability and operational efficiency. Management aims to achieve an EBITDA margin of 24–25% and move towards a net-debt-free balance sheet by FY26.

The company’s recent milestones include the first-to-file (FTF) launch of Tolvaptan in the US, licensing agreements for biosimilars like Ranibizumab in Latin America, six USFDA approvals for injectables and inhalation products, and regulatory clearance for its Nagpur Unit-II facility. Additionally, Lupin declared a 600% dividend, or ₹12 per share, underscoring management’s confidence.

Industry & Market Dynamics

The Indian pharmaceutical industry is projected to reach ₹65 lakh crore (about ₹66 lakh crore previously estimated in USD terms) by 2025 and expand further to ₹108 lakh crore by 2030, growing at a CAGR of 6%. Growth is driven by chronic disease management, increasing exports, and government incentives like the Production-Linked Incentive (PLI) scheme. Biosimilars, expected to grow at a CAGR of 22% to ₹1 lakh crore by 2025, represent a lucrative opportunity. India’s dominant role in supplying 40% of the US generic drug market also acts as a safeguard against tariff risks.

Competitive Position

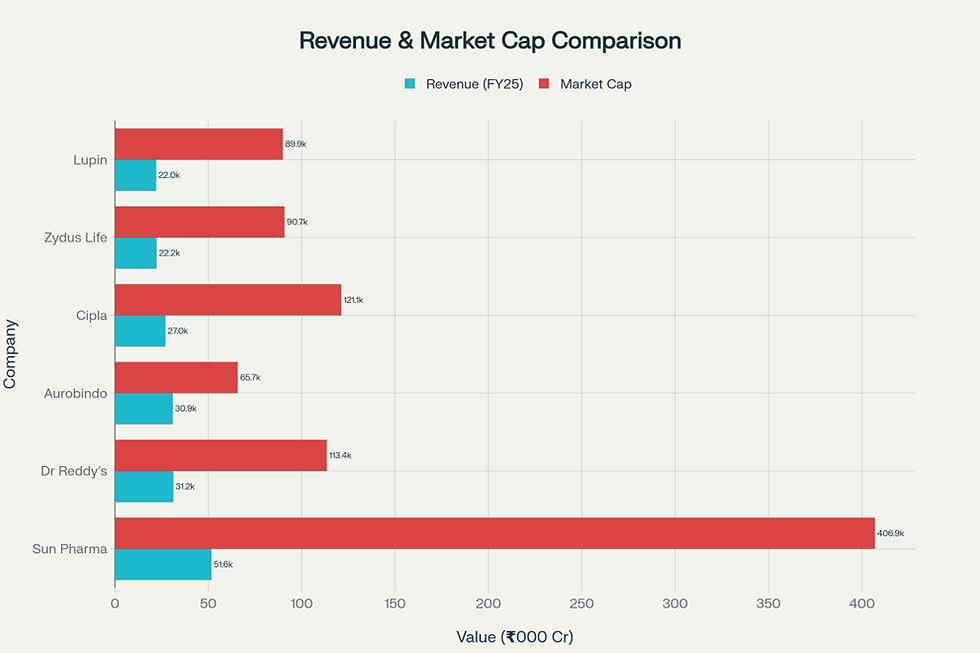

Among India’s top six pharmaceutical formulation players, Lupin ranks sixth with a 5.3% domestic market share. However, by revenue share, Lupin commands 11.9% within the peer group and boasts a higher ROE (20.6%) than larger rivals like Sun Pharma (16.9%) and Cipla (17.8%). Its valuation multiples—PE of 23.6× and PB of 5.1×—position it slightly above the sector median, reflecting investor optimism.

Portfolio & Strategy

Lupin’s growth is anchored in complex generics, including inhalation therapies (33% of US revenue), nasal sprays, and injectables. The company is also developing biosimilars like Pegfilgrastim and Etanercept, while its APIs—particularly cephalosporins, cardiovascular, and anti-TB drugs—remain core contributors. In India, Lupin plans to launch over 80 new brands across chronic therapeutic areas over the next five years.

On the international front, Lupin continues to scale its US operations with over 15 ANDA filings annually, while eyeing biosimilar commercialization by FY27. Additionally, its acquisition of the Huminsulin portfolio strengthens its presence in diabetes care.

Financial Health

Lupin’s balance sheet in FY25 reflects total assets of ₹29,205 crore, equity of ₹17,203 crore, and debt of ₹5,448 crore. With a debt-to-equity ratio of 0.32 and interest coverage at 15×, the company maintains a prudent capital structure. Liquidity remains strong with ₹2,755 crore in cash reserves.

Over FY22–FY25, revenue rose from ₹16,193 crore to ₹22,192 crore, EBITDA improved from a negative ₹439 crore to ₹5,479 crore, and net profit increased from a ₹1,528 crore loss to ₹3,282 crore profit. Margins now stand at 24.7%, while R&D investments remain steady at 8% of revenue, highlighting Lupin’s innovation-led strategy.

Risks & Outlook

Key risks include regulatory challenges, with multiple USFDA observations at Indian facilities, pricing pressure in US generics, and dependence on China for raw materials. Patent expiries in inhalation therapies may also reduce exclusivity advantages.

Despite these risks, Lupin’s premium valuation appears justified given its strong pipeline, recovery momentum, and superior ROE. Sustained compliance with FDA norms and consistent margin delivery will be critical for its growth trajectory.

Comments