Indian Railway Catering and Tourism Corporation Ltd. (IRCTC): Comprehensive Stock Analysis Report | Scrolls

- Editor

- Sep 10

- 2 min read

by KarNivesh | 10 September, 2025

Overview

Indian Railway Catering and Tourism Corporation Ltd. (IRCTC) is a unique PSU monopoly that dominates internet ticketing, catering, tourism, and packaged water services in Indian Railways. Despite strong fundamentals, its stock has corrected nearly 20% since January 2024, as growth stabilises and valuation premiums shrink. For long-term investors, IRCTC remains a steady compounder backed by solid cash flows rather than a quick-return opportunity.

Company Profile and Recent Updates

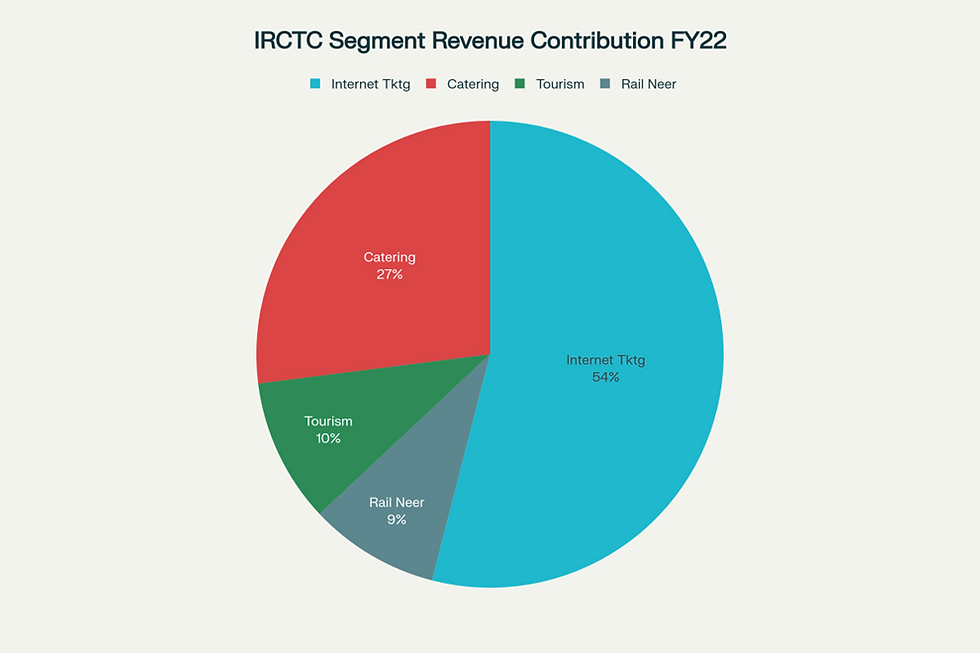

Founded in 1999, IRCTC is a “Navratna” PSU under the Ministry of Railways. Its four business verticals are:

Internet Ticketing (54% of FY22 revenue) – convenience fees, ads, and payment charges.

Catering & Hospitality (27%) – licence income from food plazas, pantry cars, and new cloud kitchens.

Tourism (10%) – Bharat Gaurav trains, hotels, and medical-tourism packages.

Rail Neer Packaged Water (9%) – covering ~70% of railway demand.

Recent developments include a Navratna upgrade (March 2025), strong Q1 FY26 results with revenue at ₹1,159 crore (+3.8% YoY) and PAT at ₹331 crore (+7.5% YoY), and digital upgrades such as QR-ticketing and e-catering cloud kitchens.

Financial Snapshot

For FY25, IRCTC posted:

Revenue: ₹4,675 crore

Net Profit: ₹1,315 crore

EPS: ₹16.7

ROE: 37.2% | ROCE: 49%

Dividend Payout: 49% (₹8 per share in FY25)

The company remains debt-free with a Debt/Equity ratio of just 0.02, and an interest coverage of 80×, giving it flexibility for future expansions.

Risks

Key risks include regulatory flip-flops on convenience fees, competition in catering and travel apps, cyber-security threats, and valuation concerns given its high P/E. Catering margins also face pressure during station modernisation.

Conclusion

IRCTC stands as a high-quality, cash-rich monopoly offering steady compounding potential. However, future returns depend on successful diversification into tourism, payments, and non-rail catering. While not a rapid wealth generator, it remains a reliable long-term PSU play for conservative investors.

Comments