India's Metal Sector: Comprehensive Industry Analysis 2025 | Scrolls

- Editor

- Aug 17

- 4 min read

by KarNivesh | 17 August, 2025

India’s metals sector stands as a central pillar of the nation’s industrial and economic growth. With the country emerging as the world’s second-largest crude steel producer, alongside significant roles in aluminum, copper, and zinc, the sector has evolved into a global powerhouse. Its growth trajectory is fueled by infrastructure development, government policy support, and rising demand from new-age industries such as electric vehicles (EVs). Yet, challenges around raw material dependence, environmental compliance, and global competition continue to shape its journey.

Steel and Non-Ferrous Segments

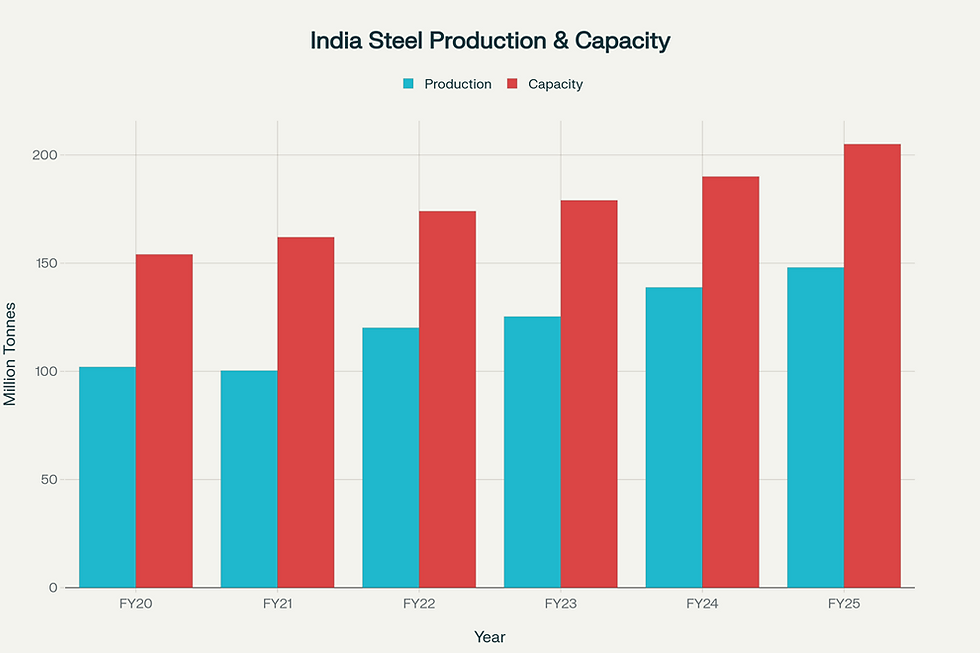

The steel sector dominates, with India’s annual production exceeding 125 million tonnes and capacity reaching 205 million tonnes in FY2025. Ambitious government targets aim to push this further to 300 million tonnes by 2030-31, with potential to reach 330 million tonnes through private investment.

Beyond steel, the aluminum industry—led by NALCO, Hindalco, Vedanta, and BALCO—maintains a combined annual capacity of nearly 42 lakh tonnes. This subsector is increasingly vital for transportation, power, and the EV ecosystem.

The copper industry, though smaller at 5.55 lakh tonnes annually, plays a critical role in power, electronics, and renewable energy infrastructure. Meanwhile, Hindustan Zinc Limited dominates zinc and lead production with a 77% market share, ranking among the world’s top integrated zinc producers.

Market Growth and Global Position

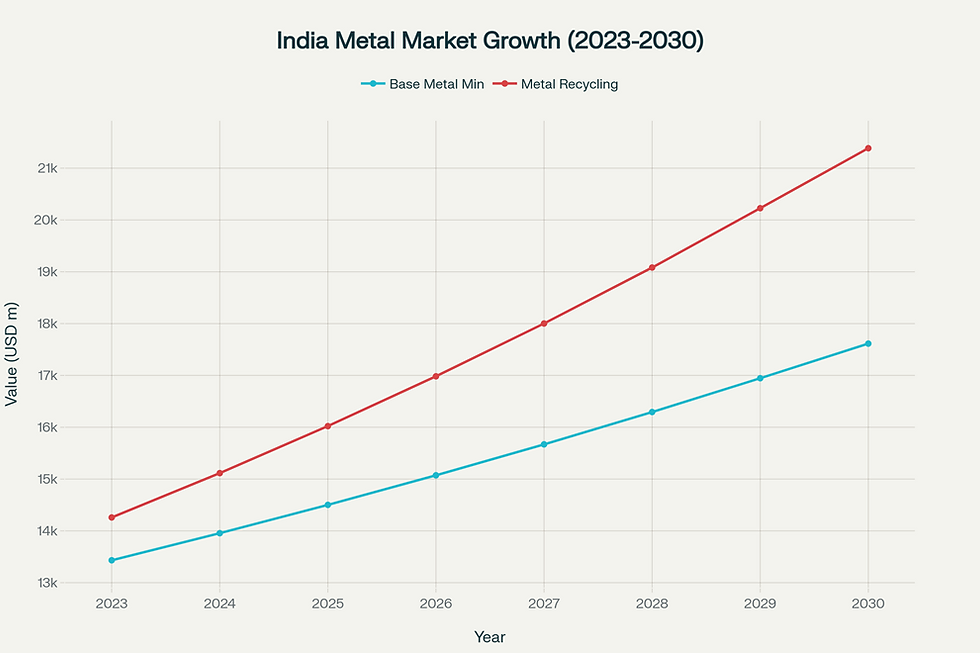

India’s metals market reflects both primary production growth and a rapid shift toward recycling and circular economy practices. In 2023, base metal mining generated USD 13.43 billion in revenue, projected to rise to USD 17.61 billion by 2030. The recycling market, valued at USD 14.26 billion in 2023, is expected to grow faster—reaching USD 21.38 billion by 2030.

Steel alone contributes about 2% of India’s GDP, with finished steel consumption reaching 152 million tonnes in FY24, an 11.5% year-over-year growth. Between 2016 and 2024, India’s steel industry grew at 6% annually, outpacing both China and the global average.

Globally, India holds the second spot in steel and aluminum production, third in lime, and fourth in iron ore. Its share of global mining revenue stands at 2.6%, while recycling accounts for 1.7% of global value.

Key Players in the Sector

India’s metals landscape is shaped by leading private and public enterprises.

Tata Steel: The sector leader, with integrated operations and strong global presence, aims for significant cost savings through operational efficiencies.

JSW Steel: The fastest-growing producer, pioneering green steel initiatives and advanced digital technologies.

SAIL: India’s largest government-owned steel producer, continuing heavy capital investments to strengthen domestic supply.

Hindalco Industries: A global force in aluminum and copper, with strong downstream presence through Novelis.

Vedanta Limited: The most diversified metals company in India, spanning zinc, copper, and aluminum.

Hindustan Zinc: A global cost leader in zinc production, consistently delivering record output and high efficiency.

Trends and Innovations

The sector is undergoing digital transformation, with Industry 4.0 tools such as AI, IoT, and predictive maintenance reshaping operations. Robotics and automation now play a growing role in inspection, handling, and quality control.

Equally critical is the shift toward sustainability. Tata Steel’s CO2 capture plant in Jamshedpur, Hindustan Zinc’s 70% renewable energy use, and experiments with green hydrogen steel production mark significant milestones. The government-backed PLI Scheme for specialty steel, worth USD 3.55 billion, is also attracting large-scale investment and innovation in advanced alloys and specialty products.

SWOT Analysis at a Glance

Strengths: Abundant natural resources, skilled workforce, strong domestic demand, and global scale in steel and aluminum.

Weaknesses: Heavy import dependence on coking coal (85%), high carbon intensity, and fragmented market structure.

Opportunities: Rising EV demand, green steel production, and specialty product exports.

Threats: Cheap imports from China, tightening environmental regulations, and raw material price volatility.

Demand and Supply Dynamics

Domestic demand remains robust, fueled by infrastructure programs like PM Awas Yojana and the Gati Shakti Master Plan. The construction sector accounts for the largest share, while the EV boom is reshaping demand for aluminum and copper.

On the supply side, capacity expansion continues aggressively. Yet, India remains heavily dependent on imports of copper, aluminum products, and coking coal—creating vulnerabilities to price and supply shocks.

Policy Support and Regulation

The government plays an active role through:

PLI schemes for specialty steel, boosting domestic value-added production.

Trade protection measures, such as safeguard duties against cheap imports.

Make in India and Atmanirbhar Bharat, encouraging domestic resource utilization and reducing import reliance.

Environmental regulations, pushing companies toward low-carbon technologies and renewable energy integration.

Challenges and Risks

The sector’s future is shaped by key risks:

Raw material dependency, especially on coking coal.

Environmental compliance costs, particularly with the EU’s Carbon Border Adjustment Mechanism (CBAM).

Technological barriers, as many older plants struggle to adopt Industry 4.0.

Market pressure from imports, which saw steel imports rise by 21.4% in FY2025.

Outlook

India’s metals sector is on a high-growth trajectory. Steel capacity is expected to surpass 300 million tonnes by 2030, supported by private sector-led expansions. Non-ferrous metals like copper and aluminum are also set for strong growth, particularly with EV adoption and renewable energy projects.

With continued digital transformation, green innovation, and policy support, India is positioning itself as a global leader in both production scale and sustainable manufacturing. At the same time, addressing raw material vulnerabilities and global competition will be essential to realizing its long-term potential.

Conclusion

India’s metals sector is at the cusp of a structural transformation. From being a volume-driven commodity producer, it is steadily evolving into a technology-driven, value-added, and sustainability-focused industry. With strong demand fundamentals, government support, and large-scale private investments, the sector’s long-term outlook remains highly promising—placing India firmly on the path to becoming a global metals powerhouse by the next decade.

Comments