How Y Combinator Transforms Early-Stage Startups into Billion-Dollar Companies

- Editor

- Oct 22

- 5 min read

by KarNivesh | 22 October, 2025

Imagine walking into a room with just an idea on paper and coming out three months later with a company worth crores of rupees. That’s exactly what happens at Y Combinator (YC) — the world’s most successful startup accelerator. Since its start in 2005, YC has helped create over 5,000 startups with a combined valuation above ₹70 lakh crore, including global giants like Airbnb, Stripe, Dropbox, Reddit, and Coinbase.

Let’s break down how Y Combinator turns small ideas into billion-rupee success stories.

What Is Y Combinator?

Y Combinator is a startup accelerator — a three-month program that gives early-stage tech founders funding, mentorship, and investor connections. Founded by Paul Graham, Jessica Livingston, Robert Morris, and Trevor Blackwell, YC runs four batches a year.

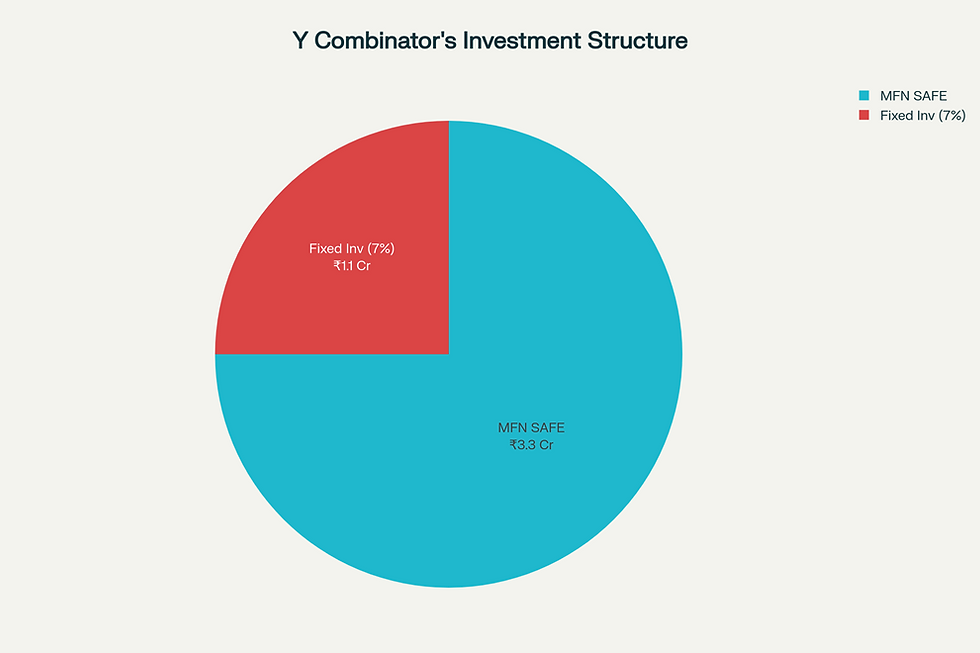

Every startup accepted receives around ₹4.4 crore (≈ $500,000). This comes as:

₹1.1 crore (≈ $125,000) for 7 % equity, and

₹3.3 crore (≈ $375,000) on an uncapped SAFE note (a future equity agreement).

In return, YC typically ends up owning about 9–10 % of the company. The program ends with Demo Day, where founders pitch to around 1,500 top investors, often raising crores more in funding.

The YC Deal Breakdown

Visual idea — show a pie chart of the ₹4.4 crore funding split and 9–10 % equity exchange.

Getting In: The YC Selection Process

Out of 15,000+ applications, only 1.5–2 % are accepted — tougher than Harvard! YC focuses on:

Clarity – Can you explain your idea in one line?

Founding team – Strong technical and business balance, good relationships, and resilience.

Market fit – A real problem that customers are willing to pay for.

Traction – Even small results matter. One company grew from ₹7 lakh to ₹8.8 crore in revenue between applications.

Those shortlisted face an intense 30–45 minute interview with YC partners. Only about 7 % of applicants reach this stage.

Inside the Three-Month YC Journey

1. Week 1 – The Bootcamp

Startups attend workshops on product development, customer discovery, and sales. Founders are grouped with 15–20 peers to learn and support one another.

2. Weeks 2-8 – The Growth Phase

Weekly sessions feature alumni like Airbnb and Stripe founders sharing lessons. Founders meet YC partners for personal guidance and focus on product-market fit, not fundraising.

3. Weeks 9-12 – Demo Day Preparation

Founders craft a 60-second pitch for investors. YC mentors help perfect clarity, storytelling, and traction metrics. Many startups close funding deals even before Demo Day.

YC 12-Week Program Timeline

Visual idea — a timeline from “Bootcamp → Growth → Demo Day,” showing key weekly milestones.

Demo Day: The Grand Finale

On Demo Day, hundreds of startups present before elite investors. Deals worth crores of rupees often happen the same day. YC’s brand credibility gives startups instant trust and access to the best venture capital firms.

In 2017 alone, 62 YC startups raised over ₹4,840 crore (≈ $550 million) in Series A funding. Altogether, YC companies have raised more than ₹7.4 lakh crore (≈ $85 billion).

Life After YC: Long-Term Support

YC’s magic continues even after the three months end.

Bookface: The Private YC Network

A private founder-only platform with 9,000+ members where entrepreneurs share advice, solutions, and job postings — saving time and money for everyone.

Investor Database

Access to details of 50,000+ investors worldwide helps founders find the right funding partners faster.

Funding Continuation

YC keeps investing in alumni companies through Series A (₹17–88 crore) and beyond.

The YC Brand

Being a YC startup instantly signals quality and reliability to investors, customers, and partners.

YC’s Ecosystem

Visual idea — network map showing YC → Funding → Mentorship → Investors → Alumni Support.

Why Y Combinator Works

High Selection Quality: Only the best startups get in, raising overall success chances.

Structured Intensity: A focused 3-month sprint builds discipline and clarity.

Strong Mentorship: Guidance from seasoned founders saves years of trial and error.

Powerful Networks: Direct access to top VCs and successful alumni.

Brand Value: “YC-backed” opens global doors.

The results prove it:

Unicorns: Over 100 companies valued above ₹8,800 crore (≈ $1 billion).

Series A Success: 45 % of YC startups raise Series A vs. 33 % of others.

Survival: 50 % of YC startups still active after 10 years.

Total Value: ₹70 lakh crore combined valuation, ₹8.8 lakh crore annual revenue.

Top performers include:

Airbnb – Valued at ₹8.27 lakh crore

Stripe – ₹6.16 lakh crore

DoorDash – ₹94,000 crore

Dropbox – ₹2.2 lakh crore

YC vs Other Accelerators

Visual idea — bar chart comparing Y Combinator, Techstars, and 500 Global on unicorn rate, Series A success, and survival rate.

Iconic Success Stories

Airbnb

The founders joined YC in 2009 with maxed-out credit cards and no growth. With YC’s mentorship, they achieved “ramen profitability” within weeks — enough to cover rent and survive.Today, Airbnb is worth around ₹8.27 lakh crore and has changed how the world travels.

Stripe

In 2010, the Collison brothers built Stripe during YC to make online payments easier. Their obsession with simple design and developer-friendly tools helped Stripe grow into a ₹6.16 lakh crore global fintech leader.

Dropbox

Founded in 2007, Drew Houston used YC’s guidance to turn a simple file-sharing idea into a product loved by millions. Dropbox now earns about ₹2.2 lakh crore annually and serves 700 million users.

Deel

A newer YC success, Deel (2019 batch) provides global payroll and compliance solutions. It reached ₹7,000 crore annual revenue and ₹1.06 lakh crore valuation within five years — one of YC’s fastest-growing companies.

YC Success Timeline

Visual idea — milestones from 2005 (launch) → Airbnb 2009 → Stripe 2010 → Deel 2019 → 2025 (5,000 startups, ₹70 lakh crore valuation).

What Y Combinator Can’t Do

Even YC can’t guarantee success. Roughly 80–90 % of startups still fail or remain small. YC can’t fix poor founder skills or force market demand. Success still depends on founder quality, execution, and persistence.

Should You Apply?

You should apply if:

Your business is tech-driven and scalable.

You have a committed, balanced founding team.

You’re early-stage and can dedicate three months in San Francisco.

You’re comfortable giving up about 9–10 % equity for ₹4.4 crore plus massive non-monetary value.

You might skip YC if you already have funding at a high valuation or are running a local, non-tech business.

Conclusion:

Y Combinator combines selectivity, speed, mentorship, networks, and credibility to transform early-stage ideas into global success stories.

Its alumni show that with focus, resilience, and the right support, even small startups can grow into companies worth thousands of crores.

For ambitious founders, YC offers more than money — it offers the knowledge, community, and momentum to build something that truly matters.

Comments