Gujarat Fluorochemicals Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Aug 29

- 4 min read

by KarNivesh | 29 August, 2025

When we talk about promising companies in India’s specialty chemicals sector, Gujarat Fluorochemicals Limited (GFL) often comes into the spotlight. The company has been making headlines for its strong financial growth, global expansion, and entry into exciting new areas like electric vehicle (EV) battery materials. But at the same time, investors need to keep in mind the challenges and risks that come with this journey. Let’s break it down in simple terms.

Who is Gujarat Fluorochemicals?

GFL is one of India’s leading chemical manufacturers, best known for its work with fluoropolymers, specialty chemicals, and refrigerants. These may sound technical, but in simple words, their products are widely used in industries like cars, electronics, construction, renewable energy, and even the fast-growing EV sector.

The company operates globally, with a presence not just in India but also in Europe, Morocco, and the United States. This global footprint helps spread its risks and opens the door to more growth opportunities.

Big Plans for the Future

One of the most exciting moves by GFL is its push into the electric vehicle space. The company has created a subsidiary called GFCL EV Products Ltd, which will focus on battery materials — a crucial piece of the EV revolution. GFL has announced plans to invest ₹6,000 crores in this area over the next few years. If successful, this could become a big revenue driver in the future.

Apart from that, GFL is also spending money on expanding its existing chemical capacity. With a ₹1,200 crore investment plan for FY2025, the company is focusing on producing more high-value products like advanced fluoropolymers and battery chemicals. It has also completed its Lithium Iron Phosphate (LFP) plant, which is expected to start trial production soon.

All of this shows that GFL isn’t just standing still — it’s actively preparing for the next wave of industrial and technological growth.

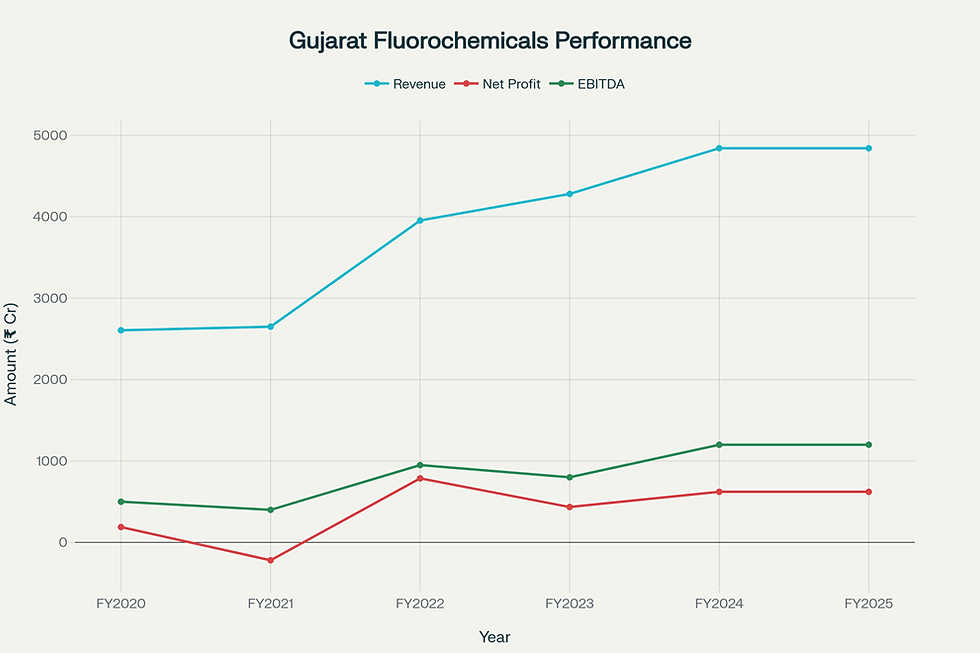

Strong Financial Performance

Numbers tell the real story, and GFL has delivered impressive results.

In Q1 FY2026, its revenue touched ₹1,304 crores, which is a 10% growth compared to last year.

Net profit jumped by a huge 70%, reaching ₹184 crores.

Expenses grew only by 2%, showing that the company is controlling costs well.

For the full year FY2025, GFL earned a total income of ₹4,842 crores, growing steadily at an average of more than 13% annually over the past five years.

When we look at its balance sheet, GFL looks financially healthy. Its debt levels are low, with a debt-to-equity ratio of just 0.1, meaning it is not heavily dependent on borrowed money. The company also has a solid equity base and a good liquidity position to manage short-term needs.

Shareholding and Market Confidence

Promoters, who are basically the founding family and key insiders, own about 62.6% of the company. This shows their strong commitment. Retail investors hold around 22%, while mutual funds and foreign investors together own about 11.5%. The presence of mutual funds and foreign institutions is a good sign since it shows professional investors have confidence in the company’s future.

The Catch: Valuation

Now, here’s where investors need to be careful. GFL’s stock is trading at a high price compared to its earnings — its Price-to-Earnings (PE) ratio is nearly 60, which is almost double its historical average. In simple terms, the stock is expensive right now.

This premium valuation reflects the high expectations the market has from the company’s future growth, especially in EV materials. But it also means that if things don’t go as planned, the stock could see corrections.

Metric | Gujarat Fluorochemicals | Navin Fluorine | Vinati Organics | Aarti Industries | Industry Average |

Market Cap (₹ Cr) | 37,576 | 24,530 | 17,837 | 14,004 | 29,737 |

PE Ratio | 59.63 | 69.18 | 41.94 | 59.09 | 57.57 |

PB Ratio | 5.15 | 9.36 | 7.22 | 5.85 | 6.90 |

ROE (%) | 7.6 | 8.2 | 15.3 | 4.5 | 9.0 |

Debt/Equity | 0.1 | 0.2 | 0.1 | 0.3 | 0.2 |

Growth Prospects

The future looks bright for GFL because of several reasons:

EV Push: With global demand for EVs rising, battery materials will be in huge demand, and GFL is entering at the right time.

Capacity Expansion: More production facilities mean more sales potential.

International Growth: GFL already earns almost half of its revenue from outside India, and it is planning to enter 10 new markets.

Innovation: From 5G materials to semiconductors, GFL is targeting advanced technology areas, giving it an edge over competitors.

Risks to Keep in Mind

Every company has its risks, and GFL is no exception.

Its heavy reliance on fluoropolymers (58% of revenue) creates concentration risk.

The chemicals industry is highly regulated, and stricter environmental rules could impact operations.

Raw material price volatility and competition from Chinese players can also affect profitability.

Finally, being in a cyclical industry, demand for its products can go down during economic slowdowns.

What Analysts Say

Market experts are mostly positive on GFL. Out of 13 analysts, the majority recommend buying the stock, while a few are cautious due to its high valuation. The average target price is around ₹3,877, suggesting moderate upside potential from current levels.

Key Takeaways

Strengths: Strong profit growth, low debt, global presence, and exciting new investments in EV battery materials.

Concerns: High stock valuation, industry risks, and execution challenges in new ventures.

Suitability: Best for investors who are looking for long-term growth opportunities and are comfortable with some volatility in stock prices.

Final Word

Gujarat Fluorochemicals is a company that has successfully grown over the years and is now stepping into some of the most exciting growth areas of the future. Its strong financials, global footprint, and bold investments make it an attractive story. But with its stock trading at a premium, investors should carefully weigh the risks before jumping in.

If you’re a long-term investor who believes in the EV revolution and specialty chemicals, GFL could be worth keeping an eye on — ideally looking for opportunities to buy during price corrections.

Comments