BHARTI HEXACOM Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Sep 10

- 2 min read

by KarNivesh | 10 September, 2025

Bharti Hexacom Limited has quickly emerged as a strong contender in India’s fast-growing telecom industry. Since its IPO in April 2024, the company has impressed investors with rapid growth, solid financials, and a strong presence in underserved regions like Rajasthan and Northeast India. Operating under the trusted Airtel brand, the company provides both mobile and broadband services and has become a key regional leader.

Strong Business Foundation

Bharti Hexacom was incorporated in 1995 and today functions as a subsidiary of Bharti Airtel. Airtel holds 70% of the company’s stake, while the Government of India (through TCIL) owns the remaining 30%. This balance gives the company both private efficiency and government backing.

With a customer base of nearly 28.1 million, the company operates in two circles – Rajasthan and the Northeast states. These regions still have below-average teledensity and internet penetration, meaning huge potential for future growth.

Revenue and Segment Performance

The company earns its revenue mainly from mobile services, which contribute 97.6% of its total income. These include voice and data services on 2G, 4G, and now 5G networks. The Homes & Office segment, though smaller at 2.4%, is growing steadily by offering fixed broadband and digital TV through cable operator partnerships.

Bharti Hexacom has been expanding fast – its home broadband presence grew from just 23 cities in FY21 to 93 cities by FY24. It also has a massive retail reach with over 89,000 touchpoints across its markets.

Financial Highlights

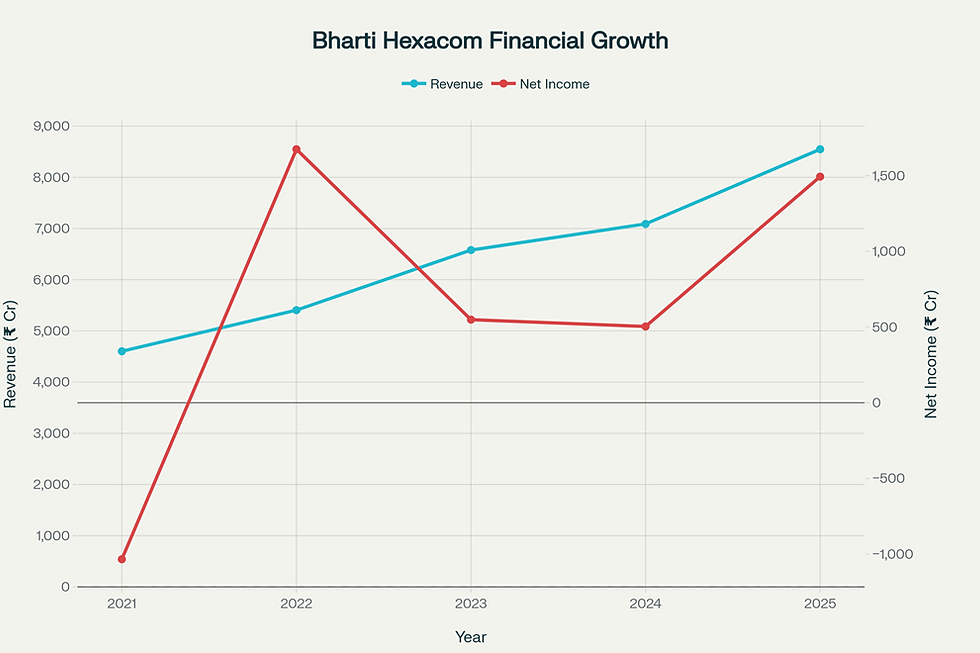

From FY20 to FY24, the company’s revenue grew at a 17% CAGR. In FY25, revenue touched ₹8,548 crores, a 20.6% increase from the previous year. Net profit for FY25 reached ₹1,494 crores, which is a 196% jump compared to FY24.

The company’s margins have also strengthened. EBITDA margin rose to 51.2% in FY25, while net profit margin stood at 17.5%. Return on Equity (ROE) improved to 25.2%, much higher than many industry peers.

On the balance sheet front, Bharti Hexacom has been reducing debt. Total borrowings dropped from ₹8,105 crores in FY24 to ₹7,353 crores in FY25, and its debt-to-equity ratio improved from 1.75x to 1.24x. This shows financial discipline and strength.

Valuation and Market Performance

As of September 2025, Bharti Hexacom trades at around ₹1,770 per share with a market capitalization of ₹88,527 crores. The stock has delivered a return of over 117% since its IPO price of ₹813.30. Investors have rewarded its growth story, and despite a high P/E ratio of 64.57, the strong fundamentals justify the premium valuation.

Opportunities and Risks

The biggest growth drivers are rising smartphone usage, higher data consumption, and expansion of broadband services. The company is also investing in 5G, digital partnerships, and customer premiumization.

However, risks include competition from Reliance Jio and Vodafone Idea, heavy capital requirements for technology upgrades, and dependence on only two regional markets.

Conclusion

Bharti Hexacom is shaping up as one of India’s most exciting telecom growth stories. With rapid revenue and profit growth, strong balance sheet management, and strategic support from Airtel, the company is well-placed to capture future opportunities. For long-term investors seeking exposure to India’s digital infrastructure boom, Bharti Hexacom looks like a strong bet.

Comments