Bharti Airtel Limited: Comprehensive Stock Analysis Report | Scrolls

- Editor

- Sep 8

- 3 min read

by KarNivesh | 08 September, 2025

Bharti Airtel has grown into one of India’s strongest and most reliable telecom players, standing tall despite intense competition in the industry. Over the past few years, the company has not only defended its market share against rivals like Reliance Jio but also expanded into new services such as 5G, broadband, digital payments, and enterprise solutions. Let’s break down what makes Airtel such a powerful force in the telecom space.

Strong Market Presence

Headquartered in New Delhi, Airtel operates across 17 countries in Asia and Africa and serves over 550 million customers worldwide. In India alone, it has more than 350 million mobile users, millions of broadband subscribers, and a large base in digital TV. This makes Airtel one of the top three mobile operators globally.

What sets Airtel apart is its wide portfolio. Beyond just mobile services, it offers high-speed internet through Airtel Xstream Fiber, digital entertainment, financial services via Airtel Payments Bank, and enterprise solutions like cloud computing and cybersecurity. This diversification reduces dependence on one revenue stream and strengthens its position in the market.

Financial Strength and Growth

The financial turnaround of Airtel in recent years has been remarkable. In FY2025, its revenue touched ₹1,72,985 crores, marking a healthy growth of over 15% compared to the previous year. Even more impressive was the profit growth — net income jumped by 349% to ₹33,556 crores.

Earnings per share also surged, showing how efficiently the company has been managed. Margins have improved significantly, with EBITDA margins climbing to nearly 59%, highlighting Airtel’s ability to control costs while boosting revenues. Return on Equity (ROE) and Return on Capital Employed (ROCE) are both strong, signaling efficient use of capital and shareholder value creation.

Managing Debt Wisely

Telecom is a capital-heavy business, especially with ongoing 5G expansion. Yet, Airtel has managed to reduce its debt levels steadily. Its debt-to-equity ratio dropped from 1.86 to 1.31 in FY2025, proving that the company is balancing growth investments with financial discipline. With healthy cash reserves, Airtel is well placed to pursue future opportunities.

Stock Market Performance

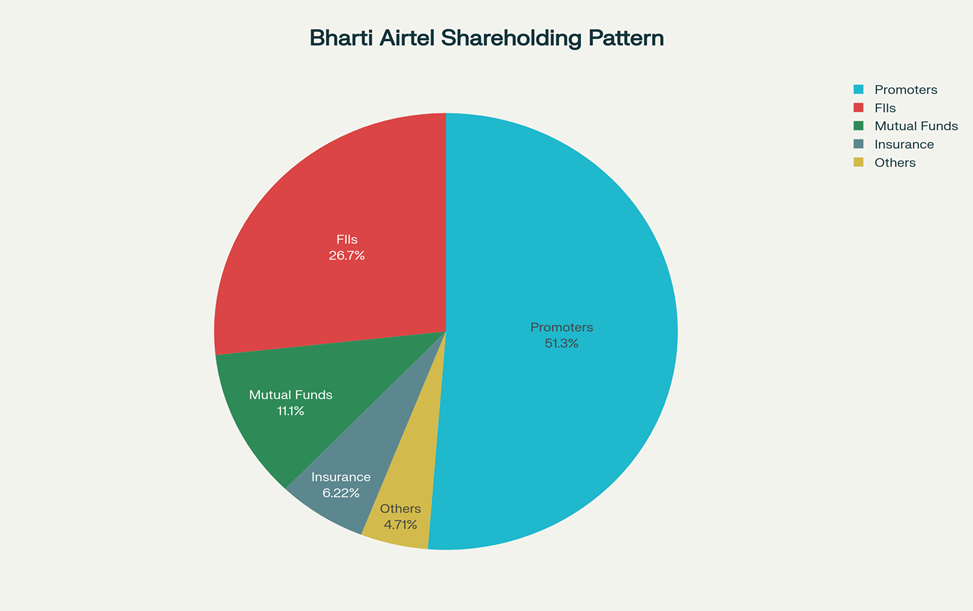

For investors, Airtel has been a rewarding bet. The stock price climbed from around ₹691 in 2022 to nearly ₹1,895 by 2025, delivering over 170% returns in just three years. The company enjoys strong investor confidence, reflected in rising foreign institutional investments. While its valuation is slightly on the premium side, the growth story makes it attractive for long-term investors.

Future Growth Drivers

Looking ahead, Airtel’s big focus is on 5G expansion. With millions of new 5G customers already onboard, it is strengthening its network through partnerships with tech giants like Nokia and Qualcomm. Beyond telecom, Airtel is betting big on digital services, fintech through Airtel Payments Bank, and enterprise solutions — all high-growth areas in India’s digital economy.

Final Thoughts

Bharti Airtel has transformed itself from surviving a brutal price war to becoming a market leader with strong financials and multiple growth engines. Its balanced approach of expanding services, managing debt smartly, and focusing on customer experience positions it as a key player in India’s digital future.

For investors and customers alike, Airtel is not just a telecom operator — it’s a digital partner powering the next phase of connectivity.

Comments